Summary

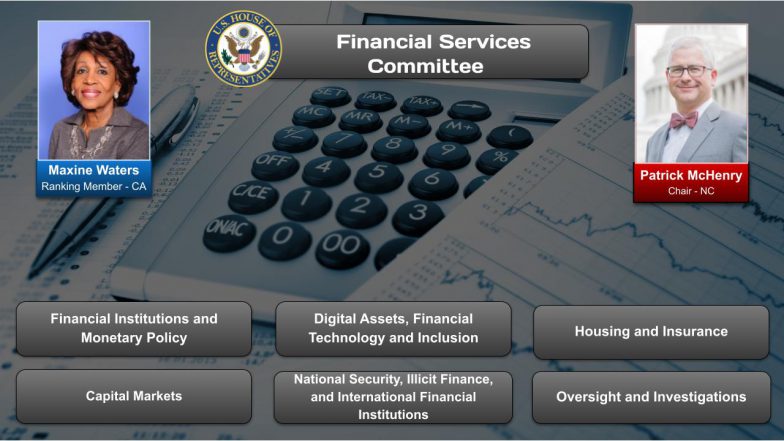

The Committee on Financial Services, also referred to as the House Banking Committee, oversees the entire financial services industry, including the securities, insurance, banking and housing industries. The Financial Services Committee also oversees the work of the Federal Reserve, the United States Department of the Treasury, the U.S. Securities and Exchange Commission and other financial services regulators.

Senate counterpart: Committee on Banking, Housing, and Urban Affairs

Subcommittees:

- Capital Markets

- Digital Assets, Financial Technology and Inclusion

- Financial Institutions and Monetary Policy

- Housing and Insurance

- National Security, Illicit Finance, and International Financial Institutions

Chair: Patrick McHenry, North Carolina (R)

Ranking Member: Maxine Waters, California (D)

Majority Staff Director: Matt Hoffmann

Minority Staff Director: Charla Ouertatani

Meeting Location: 2129 Rayburn House Office Building Washington, DC 20515

(202) 225-7502

Featured Video:

The Promises and Perils of Central Bank Digital Currencies – July 28, 2021

OnAir Post: Financial Services Committee

News

Press Releases and news can be found here at the committee website.

House Committee on Financial Services, – October 15, 2021

Today, Congresswoman Maxine Waters (D-CA), Chairwoman of the House Committee on Financial Services, gave the following statement at a Subcommittee on Housing, Community Development and Insurance virtual hearing entitled, “Zoned Out: Examining the Impact of Exclusionary Zoning on People, Resources, and Opportunity.”

Thank you very much, Mr. Chairman for holding this hearing. It’s very important. In America today, our zip code preordains our access to jobs, homeownership, affordable rents, and a child’s access to quality education. It began with enslaving and later segregating my ancestors, stripping our Indigenous brothers and sisters from their land, redlining people of color out of homeownership, and it continues today with restrictive and exclusionary zoning policies. Communities across this country continue to use zoning and local control as a dog whistle to preserve racial residential segregation that contributes to the undersupply of housing. We must ensure every family in America has access to the communities of their choice. So, I look forward to our expert witnesses for their testimony today. Again, I thank you for holding this hearing.

Novogradac – September 14, 2021

The U.S. House of Representatives Financial Services Committee today voted to approve legislation that drives $322 billion to housing and community development resources. The committee’s budget amendment includes $80 billion to build, preserve or retrofit more than 3 million affordable housing units, with $37 billion for the National Housing Trust Fund, $35 billion for the HOME program and $10 billion for the Capital Magnet Fund. The bill includes $90 billion in rental assistance to low-income renters, including $75 billion for hundreds of thousands of Housing Choice vouchers, with $25 billion of those funds aimed at helping those who have experienced or are at risk of experiencing homelessness. Eighty billion dollars is aimed at addressing public housing capital backlog. The legislation provides $8.5 billion for Community Development Block Grant (CDBG) funding, including targeted funding for colonias and manufactured housing communities. The bill includes $10 billion in first-time, first-generation homebuyer down payment assistance. The bill provides $2 billion for the Indian Housing Block Grant Program and $9.64 billion for a housing investment fund.

About

Jurisdiction

Clause 1(h) of rule X of the Rules of the House of Representatives for the 113th Congress sets forth the jurisdiction of the Committee on Financial Services as follows –

(1) Banks and banking, including deposit insurance and Federal monetary policy.

(2) Economic stabilization, defense production, renegotiation, and control of the price of commodities, rents, and services.

(3) Financial aid to commerce and industry (other than transportation).

(4) Insurance generally.

(5) International finance.

(6) International financial and monetary organizations.

(7) Money and credit, including currency and the issuance of notes and redemption thereof; gold and silver, including the coinage thereof; valuation and revaluation of the dollar.

(8) Public and private housing.

(9) Securities and exchanges.

(10) Urban development.

Source: Committee website

Members

Republican Members (Majority)

Chair: Patrick McHenry, North Carolina

Frank Lucas, Oklahoma

Pete Sessions, Texas

Bill Posey, Florida

Blaine Luetkemeyer, Missouri

Bill Huizenga, Michigan

Ann Wagner, Missouri

Andy Barr, Kentucky

Roger Williams, Texas

French Hill, Arkansas, Vice Chair

Tom Emmer, Minnesota

Barry Loudermilk, Georgia

Alex Mooney, West Virginia

Warren Davidson, Ohio

John Rose, Tennessee

Bryan Steil, Wisconsin

William Timmons, South Carolina

Ralph Norman, South Carolina

Dan Meuser, Pennsylvania

Young Kim, California

Byron Donalds, Florida

Andrew Garbarino, New York

Scott L. Fitzgerald, Wisconsin

Mike Flood, Nebraska

Mike Lawler, New York

Monica De La Cruz, Texas

Andy Ogles, Tennessee

Erin Houchin, Indiana

Zach Nunn, Iowa

Democratic Members (Minority)

Ranking Member: Maxine Waters, California

Nydia Velázquez, New York

Brad Sherman, California

Gregory Meeks, New York

David Scott, Georgia

Stephen Lynch, Massachusetts

Al Green, Texas

Emanuel Cleaver, Missouri

Jim Himes, Connecticut

Bill Foster, Illinois

Joyce Beatty, Ohio

Juan Vargas, California

Josh Gottheimer, New Jersey

Vicente Gonzalez, Texas

Sean Casten, Illinois

Ayanna Pressley, Massachusetts

Steven Horsford, Nevada

Rashida Tlaib, Michigan

Ritchie Torres, New York

Sylvia Garcia, Texas

Nikema Williams, Georgia

Wiley Nickel, North Carolina

Brittany Pettersen, Colorado

Contact

Email: Financial Services Committee

Locations

U.S. House Committee on Financial Services Democrats

2129 Rayburn House Office Building

Washington, DC 20515

Phone: (202) 225-4247

Fax: 202) 225-6952

Web Links

- Government Site

- House Telephone Directory

- Senate Committee on Banking, Housing, and Urban Affairs

- OnAir Post: Financial Services Committee

- Chair, Patrick McHenry

- Ranking Member, Maxine Waters

- Wikipedia

- YouTube

Legislation

Markups

Source: Committee website

Hearings

Source: Committee website

Subcommittees

Capital Markets

Source: Wikipedia

Jurisdiction

The subcommittee reviews laws and programs related to the U.S. capital markets, the securities industry, and government-sponsored enterprises, such as Fannie Mae and Freddie Mac. It also oversees the Securities and Exchange Commission and self-regulatory organizations, such as the New York Stock Exchange and the Financial Industry Regulatory Authority, that police the securities markets.

In 2001 the jurisdiction over insurance was transferred to the then-House Banking and Financial Services Committee from the House Energy and Commerce Committee. Since that time it has been the purview of the Subcommittee on Capital Markets, Insurance and Government Sponsored Enterprises. But “with plans to reform Fannie Mae and Freddie Mac expected to take up much of that panel’s agenda, insurance instead [was] moved to a new Subcommittee on Insurance, Housing and Community Opportunity [as of the 112th Congress].”

Republican Members (Majority)

Chair: Ann Wagner, Missouri

Frank Lucas, Oklahoma

Pete Sessions, Texas

Bill Huizenga, Michigan

French Hill, Arkansas

Tom Emmer, Minnesota

Alex Mooney, West Virginia

Bryan Steil, Wisconsin

Dan Meuser, Pennsylvania

Andrew Garbarino, New York, Vice Chair

Mike Lawler, New York

Zach Nunn, Iowa

Erin Houchin, Indiana

Democratic Members (Minority)

Ranking Member: Brad Sherman, California,

Gregory Meeks, New York

David Scott, Georgia

Juan Vargas, California

Josh Gottheimer, New Jersey

Vicente Gonzalez, Texas

Sean Casten, Illinois

Wiley Nickel, California

Stephen Lynch, Massachusetts

Emanuel Cleaver, Missouri

Digital Assets, Financial Technology and Inclusion

Source: Wikipedia

Jurisdiction

The jurisdiction of the Subcommittee on Diversity and Inclusion (117th Congress) includes —

- all matters related to diversity and inclusion within all the agencies, departments, programs, and entities within the jurisdiction of the committee, including workforce diversity and inclusion, external or customer diversity and inclusion, and supplier diversity;

- the Offices of Minority and Women Inclusion within the federal financial agencies

- methods, initiatives, and measures to promote financial and economic inclusion for all consumers.

Republican Members (Majority)

Chair: French Hill, Arkansas

Frank D. Lucas, Oklahoma

Tom Emmer, Minnesota

Warren Davidson, Vice Chairman

John Rose, Tennessee

Bryan Steil, Wisconsin

William Timmons, South Carolina

Byron Donalds, Florida

Mike Flood, Nebraska

Erin Houchin, Indiana

Democratic Members (Minority)

Ranking Member: Stephen F. Lynch, Massachusetts

Bill Foster, Illinois

Josh Gottheimer, New Jersey

Ritchie Torres, New York

Brad Sherman, California

Al Green, Texas

Sean Casten, Illinois

Wiley Nickel, North Carolina

Financial Institutions and Monetary Policy Digital Assets, Financial Technology and Inclusion

Source: Wikipedia

Jurisdiction

The subcommittee oversees all financial regulators, such as the Federal Deposit Insurance Corporation and the Federal Reserve, all matters pertaining to consumer credit including the Consumer Credit Protection Act and access to financial services, as well as the safety and soundness of the banking system.

Republican Members (Majority)

Chair: Andy Barr, Kentucky

Bill Posey, Florida

Blaine Luetkemeyer, Missouri

Roger Williams, Texas

Barry Loudermilk, Georgia, Vice Chair

John Rose, Tennessee

William Timmons, South Carolina

John Rose, Tennessee

Ralph Norman, South Carolina

Scott L. Fitzgerald, Wisconsin

Young Kim, California

Byron Donalds, Florida

Monica De La Cruz, Texas

Andy Ogles, Tennessee

Democratic Members (Minority)

Ranking Member: Bill Foster, Illinois

Nydia Velázquez, New York

Brad Sherman, California

Gregory Meeks, New York

David Scott, Georgia

Al Green, Texas

Joyce Beatty, Ohio

Juan Vargas, California

Sean Casten, Illinois

Ayanna Pressley, Massachusetts

Housing and Insurance

Source: Wikipedia

Jurisdiction

The Housing, Community Development and Insurance subcommittee oversees the U.S. Department of Housing and Urban Development and Ginnie Mae. The subcommittee also handles matters related to public, affordable, and rural housing, as well as community development including Empowerment Zones, and government-sponsored insurance programs, such as the National Flood Insurance Program. The jurisdiction over insurance was transferred in 2001 to the then-House Banking and Financial Services Committee from the House Energy and Commerce Committee. Since that time it had been the purview of the Subcommittee on Capital Markets, Insurance and Government Sponsored Enterprises. But “with plans to reform Fannie Mae and Freddie Mac expected to take up much of that panel’s agenda, insurance instead [was] moved to a new Subcommittee on Insurance, Housing and Community Opportunity [as of the 112th Congress].

Republican Members (Majority)

Chair: Warren Davidson, Ohio

Bill Posey, Florida

Blaine Luetkemeyer, Missouri

Ralph Norman, South Carolina

Scott Fitzgerald, Wisconsin

Andrew Garbarino, New York

Mike Flood, Nebraska

Mike Lawler, New York

Monica De La Cruz, Texas, Vice Chairwoman

Erin Houchin, Indiana

Democratic Members (Minority)

Ranking Member: Emanuel Cleaver, II, Missouri

Nydia M. Velázquez, New York

Rashida Tlaib, Michigan

Ritchie Torres, New York

Ayanna Pressley, Massachusetts

Sylvia Garcia, Texas

Nikema Williams, Georgia

Steven Horsford, Nevada

Brittany Pettersen, Colorado

National Security, Illicit Finance, and International Financial Institutions

Source: Wikipedia

Jurisdiction

The subcommittee’s jurisdiction includes domestic monetary policy, and agencies which directly or indirectly affect domestic monetary policy; multilateral development institutions such as the World Bank; coins and currency, including operations of the United States Mint and the Bureau of Engraving and Printing; and international trade and finance including all matters pertaining to the International Monetary Fund and the Export-Import Bank of the United States.

Republican Members (Majority)

Chair: Blaine Luetkemeyer, Missouri

Andy Barr, Kentucky

Roger Williams, Texas

Barry Loudermilk, Georgia

Dan Meuser, Pennsylvania

Young Kim, California, Vice Chairwoman

Zach Nunn, Iowa

Monica De La Cruz, Texas

Andy Ogles, Tennessee

Democratic Members (Minority)

Ranking Member:

Joyce Beatty, Ohio

Vicente Gonzalez, Texas

Wiley Nickel, North Carolina

Brittany Pettersen, Colorado

Bill Foster, Illinois

Juan Vargas, California

Josh Gottheimer, New Jersey

Oversight and Investigations

Source: Wikipedia

Jurisdiction

The Subcommittee conducts oversight of the agencies, departments, and programs under the Committee’s jurisdiction. The Subcommittee also conducts investigations on any matter within the jurisdiction of the Committee, and evaluates the need for any legislative changes to the laws and programs within this jurisdiction.

Republican Members (Majority)

Chair: Bill Huizenga, Michigan

Pete Sessions, Texas

Ann Wagner, Missouri

Alexander X. Mooney, West Virginia

John Rose, Tennessee, Vice Chairman

Dan Meuser, Pennsylvania

Andy Ogles, Tennessee

Democratic Members (Minority)

Ranking Member: Al Green, Texas

Steven Horsford, Nevada

Rashida Tlaib, Michigan

Sylvia Garcia, Texas

Nikema Williams, Georgia

More Information

Agencies and Other Resources

Source: Committee website

Forums

Source: Committee website

Throughout the 113th Congress, Congresswoman Maxine Waters, Ranking Member of the Financial Services Committee, organized panel discussions on housing finance reform, TRIA, debt ceiling brinksmanship, and the Export-Import Bank. At these forums, a diverse group of experts provided presentations on each issue, engaged on and in discussion with one another, and took questions from the audience. These events were open to the public and many Democratic Members attended and were able to learn about issues not addressed by the full committee.

Campaign Finance

Source: Open Secrets webpages