Summary

This post on Inflation is 1 of 3 issues that US onAir curators are focusing on in the Economy & Jobs category.

In the United States, the Consumer Price Index rose 6.8% between November 2020 and November 2021, spurred by price increases for gasoline, food, and housing. Higher energy costs caused the inflation to rise further in 2022, reaching 9.1%, a high not seen since 1981.

In July 2022, the Fed increased the interest rate for the third time in the year,[104] yet inflation remained high outpacing the growth in wages[105] and spending. According to the Economic Policy Institute the minimum wage was worth less than any time since 1956 due to inflation.

Source: Wikipedia

OnAir Post: Inflation

News

Friday’s latest jobs report is proof again of a labor market that has been resilient and often stronger than expected. But according to numerous polls, many Americans don’t feel the economy is strong overall or helping them or their families. Economics correspondent Paul Solman reports on what’s causing the disconnect.

About

Check the Economy & Jobs post for the party positions, committees, government agencies related to Inflation and Economy & Jobs issues.

Challenges

1. Monetary Policy Dilemma:

- Central banks face a delicate balance between controlling inflation and supporting economic growth.

- Raising interest rates to curb inflation can slow economic activity, while low rates fuel further price rises.

2. Supply Chain Disruptions:

- The COVID-19 pandemic and geopolitical tensions have disrupted global supply chains, leading to shortages and price increases for goods and services.

- Resolving these disruptions is crucial for stabilizing inflation.

3. Wage-Price Spiral:

- Rising inflation can lead to demands for higher wages, which in turn drive up business costs and further increase inflation.

- Breaking this cycle requires careful coordination between governments, employers, and labor unions.

4. Fiscal Policy Impact:

- Government spending and tax policies can influence inflation.

- Excessive government spending and borrowing can contribute to price pressures, while prudent fiscal management can help mitigate inflation.

5. Global Economic Interconnectedness:

- Inflation is a global issue, and it can be impacted by factors outside a country’s control.

- Cooperation between nations is essential for addressing inflation effectively.

6. Inflation Expectations:

- Public expectations about future inflation can influence actual inflation.

- Anchoring inflation expectations at a low level is crucial for preventing a sustained inflationary cycle.

7. Communication and Transparency:

- Central banks and governments must clearly communicate their inflation targets and strategies.

- Transparent and timely information helps build trust and reduces uncertainty in markets.

8. Data Limitations:

- Inflation measurement and forecasting can be challenging, especially during periods of rapid price changes.

- Continuous improvements in data collection and analysis are necessary.

9. Social and Economic Impact:

- Inflation disproportionately affects low-income households and erodes purchasing power.

- Addressing the social and economic consequences of inflation is essential for maintaining social stability.

10. Long-Term Structural Factors:

- Inflation can also be influenced by long-term structural factors such as demographics, technological change, and climate change.

- Understanding and addressing these factors is crucial for sustainable inflation management.

Source: Google Search + Gemini + onAir curation

Solutions

Fiscal Policy Measures:

- Reduce government spending: Cut back on non-essential expenditures to reduce demand and inflationary pressures.

- Increase taxes: Raise taxes on individuals or businesses to extract money from the economy and curb spending.

- Issue government bonds: Governments can sell bonds to absorb excess money supply and reduce demand.

Monetary Policy Measures:

- Increase interest rates: Central banks raise interest rates to make borrowing more expensive and reduce economic activity.

- Reduce the money supply: Central banks sell securities to reduce the amount of money in circulation.

- Increase reserve requirements: Require banks to hold a higher percentage of their deposits as reserves, which reduces their ability to lend.

Structural Reforms:

- Increase productivity: Invest in education, infrastructure, and technology to enhance the economy’s ability to produce goods and services efficiently.

- Reduce supply chain bottlenecks: Address disruptions in transportation, logistics, and production to increase supply.

- Promote competition: Enforce antitrust laws and reduce barriers to entry to foster healthy market competition and lower prices.

Price Controls and Income Policies:

- Price ceilings: Governments set maximum prices for certain goods and services to prevent excessive increases.

- Wage and price freezes: Freeze wages and prices for a period to suppress inflation.

- Subsidies: Governments provide financial assistance to offset rising costs for consumers and businesses, mitigating the impact of inflation.

External Factors:

- Coordinate with other countries: Inflation often has international dimensions. Collaboration with other nations is essential to address global factors driving inflation.

- Reduce dependence on foreign goods: Encourage domestic production and reduce reliance on imports to minimize the impact of global supply chain disruptions.

- Negotiate trade agreements: Support free and fair trade agreements to enhance competition and reduce inflationary pressures.

Other Measures:

- Educate the public: Communicate clearly and transparently about inflation and its causes to manage expectations and maintain confidence.

- Monitor inflation data: Regularly collect and analyze inflation data to track progress and adjust policies accordingly.

- Consider exceptional measures: In extreme cases, governments may implement emergency measures, such as rationing or price controls, to prevent hyperinflation.

Source: Google Search + Gemini + onAir curation

Websites

Government Agencies:

- U.S. Federal Reserve: https://www.federalreserve.gov/

- U.S. Department of the Treasury: https://home.treasury.gov/

- U.S. Bureau of Labor Statistics (Inflation data): https://www.bls.gov/cpi/#data

International Organizations:

- International Monetary Fund (IMF): https://www.imf.org/

- World Bank: https://www.worldbank.org/

- Organization for Economic Co-operation and Development (OECD): https://www.oecd.org/

Non-Profit Research Organizations:

- Brookings Institution: https://www.brookings.edu/

- Peterson Institute for International Economics: https://www.piie.com/

- American Enterprise Institute (AEI): https://www.aei.org/

Media Outlets:

- The Wall Street Journal (Financial news): https://www.wsj.com/

- The New York Times (Business and economics): https://www.nytimes.com/section/business

- Bloomberg (Financial news and data): https://www.bloomberg.com/

Think Tanks:

- Center for American Progress: https://www.americanprogress.org/

- Heritage Foundation: https://www.heritage.org/

- Roosevelt Institute: https://rooseveltinstitute.org/

Other Resources:

- shadowstats.com: https://www.shadowstats.com/ (Alternative inflation calculations)

- inflationdata.com: https://inflationdata.com/ (Historical inflation data)

- inflationcalculator.org: https://www.inflationcalculator.org/ (Inflation calculator)

Source: Google Search + Gemini + onAir curation

Legislation

Laws

Source: Google Search + Gemini + onAir curation

. Tax Cuts and Jobs Act (2017)

- Temporarily reduced corporate and individual income taxes, aimed at stimulating economic growth and reducing inflation.

2. CARES Act (2020)

- Provided economic stimulus during the COVID-19 pandemic, including direct payments to individuals and expanded unemployment benefits.

- Potentially contributed to inflation by increasing demand.

3. American Rescue Plan Act (2021)

- Further provided economic stimulus, including additional direct payments, tax credits, and funding for state and local governments.

- Similar inflationary effects as the CARES Act.

4. Infrastructure Investment and Jobs Act (2021)

- Invested in infrastructure projects, such as roads, bridges, and broadband.

- Aimed at increasing productivity and reducing costs, potentially mitigating inflation.

5. Inflation Reduction Act (2022)

- Enacted changes to the tax code and healthcare system, with the goal of reducing the federal deficit and addressing climate change.

- Included provisions aimed at reducing prescription drug costs and energy prices, which could help lower inflation.

6. Strengthening American Cybersecurity Act (2022)

- Provided funding to improve cybersecurity, potentially reducing disruptions to supply chains and businesses impacted by cyberattacks.

7. Bipartisan Safer Communities Act (2022)

- Funded community violence prevention and mental health programs, potentially mitigating social factors that contribute to inflation.

8. Chips and Science Act (2022)

- Invested in domestic semiconductor manufacturing, aiming to reduce reliance on foreign imports and address supply chain disruptions that contribute to inflation.

9. Inflation Reduction Bonus Act (2023)

- Proposed legislation that would provide tax rebates to individuals and businesses based on their income and energy savings, potentially reducing financial burdens and lowering inflation.

10. Social Security Sustainability Act (2023)

- Proposed legislation that would increase Social Security benefits and payroll taxes gradually, potentially reducing inflationary pressures in the long term.

New Bills

Source: Google Search + Gemini + onAir curation

Federal Reserve Act Amendments of 2024

- Gives the Federal Reserve more flexibility to control inflation by allowing it to target a range of inflation rates.

- Aims to enhance the Fed’s ability to respond to inflationary pressures.

Affordable Housing and Community Development Act of 2023 (H.R. 4012)

- Provides funding for affordable housing, rent control, and homeownership assistance.

- Aims to reduce housing costs and ease inflationary pressures on families.

Supply Chain Resilience Act of 2023 (S. 3580)

- Invests in domestic manufacturing, improves logistics, and diversifies supply chains.

- Aims to reduce supply-chain disruptions that contribute to inflation.

Transportation and Infrastructure Act of 2024 (TBD)

- Provides funding for infrastructure improvements, such as roads, bridges, and public transportation.

- Aims to reduce transportation costs and mitigate the impact of inflation on businesses and consumers.

Tax Increase and Reform Act of 2023 (TBD)

- Raises taxes on corporations and high-income earners.

- Aims to reduce the budget deficit and cool demand-driven inflation.

Trade Fairness and Enforcement Act of 2024 (TBD)

- Strengthens trade enforcement mechanisms and addresses unfair trading practices.

- Aims to reduce the cost of imported goods and mitigate inflationary pressures.

Labor Market Stability Act of 2023 (TBD)

- Provides funding for workforce training, apprenticeship programs, and job placement services.

- Aims to address labor shortages and wage pressures that contribute to inflation.

Consumer Protection and Price Gouging Act of 2024 (TBD)

- Enhances consumer protections and prohibits excessive price increases during periods of high inflation.

- Aims to protect consumers from predatory pricing and mitigate inflationary pressures.

COMMITTEES, AGENCIES, & PROGRAMS

Committees

Source: Google Search + Gemini + onAir curation

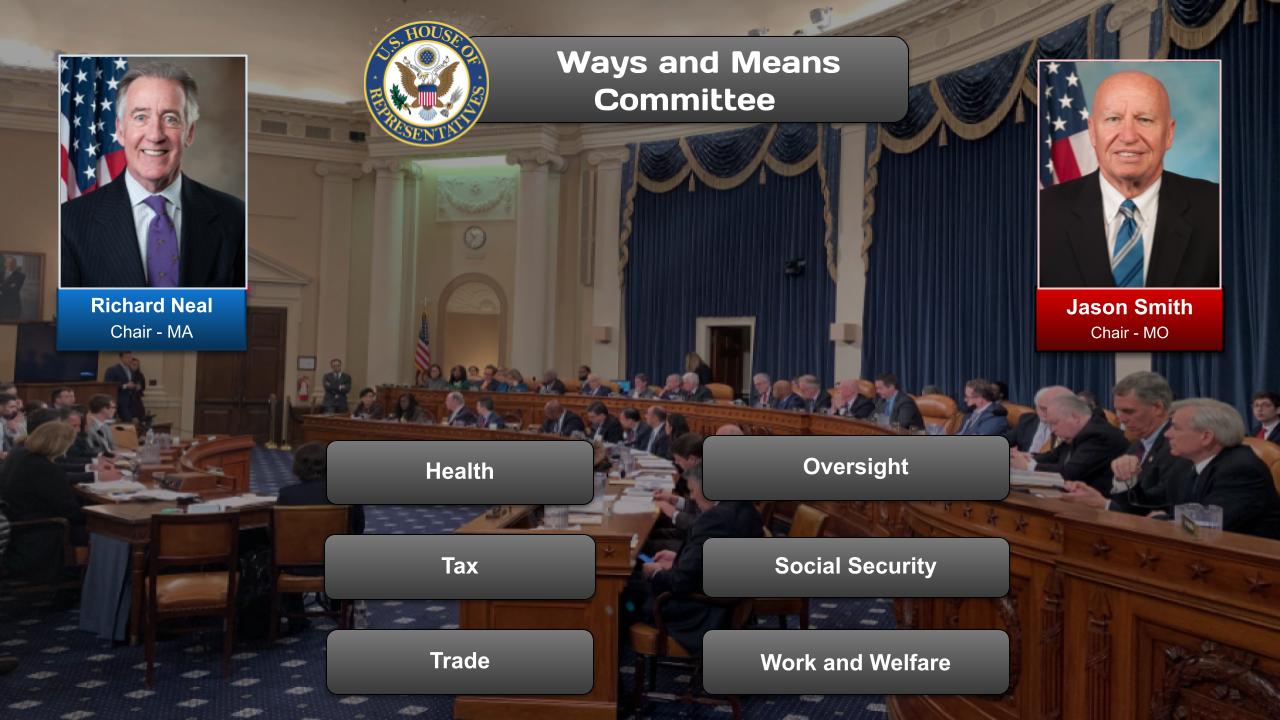

House of Representatives Committees

- House Ways and Means Committee: Responsible for tax policy, revenue generation, and trade agreements.

- House Financial Services Committee: Oversees banking, housing, and financial markets, including monetary policy and consumer protection.

- House Small Business Committee: Advocates for small businesses, which are particularly vulnerable to inflation.

Senate Committees

- Senate Finance Committee: Similar to the House Ways and Means Committee, with jurisdiction over tax policy and trade.

- Senate Banking, Housing, and Urban Affairs Committee: Handles similar issues to the House Financial Services Committee.

- Senate Committee on Small Business and Entrepreneurship: Focuses on supporting and protecting small businesses.

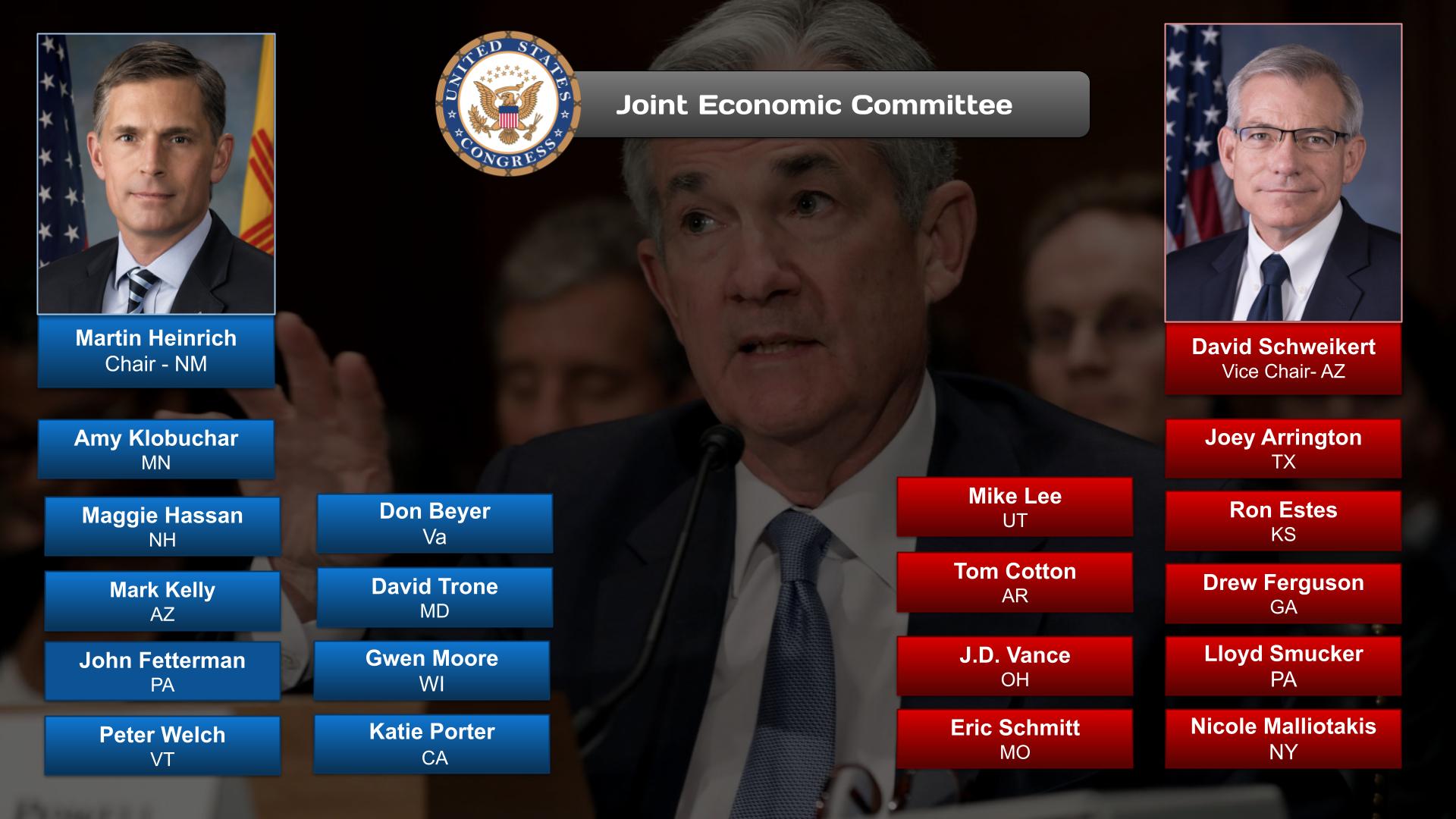

Joint Committees

- Joint Economic Committee: Provides economic analysis and policy recommendations to Congress.

- Joint Committee on Taxation: Assists Congress in interpreting and developing tax policy.

Other Relevant Committees

- House Budget Committee: Responsible for the federal budget and fiscal policy.

- Senate Appropriations Committee: Approves federal spending.

- House and Senate Agriculture Committees: Oversee agricultural policy and food prices, which are affected by inflation.

- House and Senate Energy and Commerce Committees: Handle energy policy, which can impact inflation through energy costs.

Leadership Roles

- House Speaker (Nancy Pelosi): Sets the legislative agenda for the House and coordinates with committee chairs.

- Senate Majority Leader (Chuck Schumer): Similar role to the House Speaker in the Senate.

- Chairs of relevant committees: Play a key role in setting the agenda for their committees and steering legislation.

Government Agencies

Source: Google Search + Gemini + onAir curation

Federal Reserve (Fed)

- Conducts monetary policy to control inflation by raising or lowering interest rates.

Treasury Department

- Responsible for fiscal policy, including issuing debt to fund government spending.

- Can issue new debt or increase taxes to reduce the amount of money in circulation.

Council of Economic Advisers (CEA)

- Provides economic advice to the President and Congress.

- Monitors inflation trends and analyzes policy options.

Congressional Budget Office (CBO)

- Nonpartisan agency that provides economic forecasts to Congress.

- Analyzes the effects of proposed legislation on inflation.

Consumer Price Index (CPI) Committee

- Reviews the CPI, a measure of inflation based on the prices of a basket of goods and services.

- Makes recommendations for adjustments to the CPI.

Other Agencies

- National Economic Council (NEC): Coordinates economic policy across agencies.

- Office of Management and Budget (OMB): Reviews and approves federal spending plans.

- Federal Trade Commission (FTC): Enforces antitrust laws to prevent price gouging and other inflationary practices.

- Department of Justice (DOJ): Investigates and prosecutes cases of corporate price fixing and other antitrust violations.

Programs & Initiatives

Source: Google Search + Gemini + onAir curation

Fiscal Policy

- Federal Reserve Interest Rate Adjustment: The Federal Reserve can increase interest rates to cool demand and slow economic growth, reducing inflationary pressures.

Monetary Policy

- Quantitative Tightening: The Federal Reserve reduces its holdings of Treasury securities and mortgage-backed securities, reducing the money supply and raising interest rates.

Energy Security and Supply Chain Initiatives

- Strategic Petroleum Reserve Release: The government releases crude oil from its reserve to increase supply and lower gas prices.

- Defense Production Act Invocation: President Biden invoked the Defense Production Act to prioritize production of energy-related resources and reduce supply chain bottlenecks.

- Infrastructure Investment and Jobs Act: Allocates billions of dollars to improve roads, bridges, and other infrastructure, reducing transportation costs and associated inflationary pressures.

Consumer Protection Initiatives

- Price Gouging Enforcement: The Federal Trade Commission and state governments monitor and prosecute businesses engaging in excessive price increases during inflationary periods.

- Consumer Price Index (CPI) Reporting: The Bureau of Labor Statistics publishes the CPI, which measures the average change in prices for a basket of goods and services, providing a benchmark for inflation tracking.

Other Initiatives

- Public Awareness Campaigns: The government educates consumers about the causes, consequences, and mitigation strategies for inflation.

- International Cooperation: The US collaborates with other countries to address global supply chain disruptions and coordinate inflation-fighting measures.

- Tax Relief: The government may consider tax breaks for businesses and individuals to reduce the impact of rising costs on economic activity.

More Information

Nonpartisan Organizations

Source: Google Search + Gemini + onAir curation

- The Brookings Institution is a nonpartisan think tank that conducts research and analysis on public policy issues. Brookings has a wide range of experts on inflation, including economists, sociologists, and political scientists.

- The Center on Budget and Policy Priorities is a nonpartisan research and policy institute that focuses on issues related to the federal budget and the economy. The Center has conducted extensive research on inflation and its effects on different groups of people.

- The Congressional Budget Office (CBO) is a nonpartisan agency that provides economic and budgetary advice to Congress. The CBO has produced a number of reports on inflation, including its effects on the economy and the federal budget.

- The Federal Reserve is the independent central bank of the United States. The Fed has a dual mandate of price stability and maximum employment. The Fed’s policies have a significant impact on inflation.

- The National Bureau of Economic Research (NBER) is a private, nonpartisan research organization that conducts economic research. The NBER has a number of research programs on inflation, including its causes, effects, and policy implications.

- National Association of Business Economists (NABE): A professional organization of economists from various sectors who provide economic forecasts and policy recommendations, including on inflation.

- American Economic Association (AEA): A professional association of economists that promotes economic research and policy debate, including on inflation and its consequences.

- International Monetary Fund (IMF): A multilateral institution that provides financial assistance and policy advice to its member countries, including on managing inflation.

Partisan Organizations

Source: Google Search + Gemini + onAir curation

Democratic Party Organizations

- Center for American Progress (CAP): A think tank promoting progressive policies that address inequality, including inflationary pressures on working families.

- Economic Policy Institute (EPI): A research institute focused on labor economics, inequality, and the effects of inflation on American workers.

- Brookings Institution: A nonpartisan think tank that conducts research and policy recommendations on inflation and its impact on the economy.

Republican Party Organizations

- American Enterprise Institute (AEI): A conservative think tank advocating for market-based solutions to address inflation, including reducing government spending and regulations.

- Heritage Foundation: A conservative think tank focused on promoting free markets and fiscal responsibility, including policies to control inflation.

- Hoover Institution: A public policy research center at Stanford University, which advocates for conservative economic principles that aim to reduce inflation.

“Inflation in the US” (Wiki)

Contents

| Country/Region | 2020 | 2021 | 2022 |

|---|---|---|---|

| 42.0% | 48.4% | 72.4% | |

| 0.9% | 2.8% | 6.6% | |

| 3.2% | 8.3% | 9.3% | |

| 0.7% | 3.4% | 6.8% | |

| 2.5% | 0.9% | 1.9% | |

| 0.0% | -0.2% | 2.5% | |

| 0.5% | 2.5% | 5.1% | |

| 12.3% | 19.6% | 72.3% | |

| 0.9% | 2.6% | 9.1% | |

| 1.3% | 4.7% | 8.0% | |

| Europe and Central Asia | 1.2% | 3.3% | 10.4% |

| 0.5% | 2.6% | 8.8% | |

| Latin America and Caribbean | 1.0% | 3.9% | 7.7% |

| South Asia | 5.7% | 5.5% | 7.7% |

| World | 1.9% | 3.5% | 8.0% |

A worldwide surge in inflation began in mid-2021, with many countries seeing their highest inflation rates in decades. It has been attributed to various causes, including COVID-19 pandemic-related economic dislocation, supply chain disruptions, the fiscal and monetary stimuli provided in 2020 and 2021 by governments and central banks around the world in response to the pandemic, and price gouging. Recovery in demand from the COVID-19 recession had by 2020 led to significant supply shortages across many business and consumer economic sectors. The inflation rate in the United States and the eurozone peaked in the second half of 2022 and sharply declined in 2023 and into 2024. Despite its decline, significantly higher price levels across various goods and services relative to pre-pandemic levels persist, which some economists speculate is permanent.[3][4][5][6]

In early 2022, the Russian invasion of Ukraine‘s effect on global oil prices, natural gas, fertilizer, and food prices further exacerbated the situation.[7] Higher gasoline prices were a major contributor to inflation as oil producers saw record profits. Debate arose over whether inflationary pressures were transitory or persistent, and to what extent price gouging was a factor. All central banks (except for the Bank of Japan which had kept its interest rates steady at –0.1% until 2024[8]) responded by aggressively increasing interest rates.[9][10][11][12]

Background and causes

Consumer spending on goods in the United States and elsewhere moved in tandem with spending on services (see goods and services) prior to the COVID-19 recession, but upon emerging from the recession consumers shifted spending towards goods and away from services, particularly in the United States.[13] This shift placed stress on supply chains, such that the supply of goods could not meet demand, resulting in price increases. In November 2021 inflation in the United States was 14.9% for durable goods, compared to 10.7% for consumable goods and 3.8% for services.[13] Similar situations occurred in several other major economies.[which?] Supply chain stresses increased prices for commodities and transportation, which are cost inputs for finished goods.[13]

In countries where food constituted a large part of the inflation increase,[where?] rising prices forced low-income consumers to reduce spending on other goods, thereby slowing economic growth. “In those countries with high inflation, consumer spending has weakened because household spending power has taken a hit from rising prices,” said William Jackson of Capital Economics, “And you’ve generally seen much more aggressive moves to tighten monetary policy.”[14]

In June 2022, The Atlantic published an editorial article critical towards the U.S. Department of the Treasury controlling inflation. In 2021, Janet Yellen called the risk of inflation “small” and “manageable”, and equally Federal Reserve Chairman Jerome Powell thought inflation would be “transitory”, even as inflation rose above 6 percent. In 2023, the International Monetary Fund ascertained that “food and energy are the main drivers of this inflation”, as rising prices continue to squeeze living standards not only in North America but worldwide.[15][16]

Six out of ten (59%) EU enterprises were concerned about energy prices in 2023, and five out of ten (47%) were concerned about uncertainty, with some country variations.[17] Energy cost rises were more common in EU businesses than in US firms (93% vs. 83%).[17][18] Manufacturing businesses were the most likely to have encountered a 25% or more rise in energy spending, while the construction sector had the lowest number of firms suffering a 25% or greater increase in energy spending, despite the fact that more than half of firms reported this.[17][19][20]

Fiscal and monetary policy

Among the factors contributing to the surge of inflation were the unprecedented levels of fiscal and monetary stimulus enacted to sustain household incomes and the liquidity of financial institutions in the 2020-2021 period. Many governments around the world adopted such stimulatory actions early in the COVID-19 pandemic.[21][22][23][24]

Some immediate actions were taken by banking systems across the country to combat the inflation surge, as most banks today target the rate of inflation in a country as their primary way of measuring economic flow for monetary policy. When inflation is present banks will make changes to their monetary policy by increasing interest rates or making changes to other policies. Higher interest rates make borrowing more expensive, reducing consumption. This is put into place purposely to maintain a level of consumption that will contribute to a steady level of inflation or decrease it, this is also known as inflation targeting.[25]

U.S. President Joe Biden said in August 2023 that his Inflation Reduction Act was inaptly named because it had “less to do with reducing inflation than it has to do with providing alternatives that generate economic growth,”. The Congressional Budget Office had projected the law would have negligible effect on inflation, and it did not appear to reduce inflation at all. Contrary to Republican predictions, it also did not appear to have increased inflation.[26]

Supply chain disruptions

Some economists[27] attribute the U.S. inflation surge to product shortages resulting from the global supply-chain problems, itself largely caused by the COVID-19 pandemic.[28] This coincided with strong consumer demand, driven by low unemployment and improved financial conditions following the pandemic.[29] The higher demand caused by the U.S. government’s $5 trillion aid spending exacerbated supply-side issues in the United States; according to the Federal Reserve Bank of San Francisco researchers, this contributed 3 percentage points to inflation by the end of 2021.[30] They argued that the spending measures were nevertheless necessary to prevent deflation, which would’ve been harder to manage than inflation.[31]

Consumer prices have reached an all-time high within the last thirty years, soaring by 6.2% from the previous year, things like restaurant prices to clothes and the most popular being fuel, have drastically increased.[32] Fuel prices rose by 49% from January to June 2022 in the United States.[33] During the pandemic, the number of workers working worldwide plunged and had an immediate impact on the United States as less than a third of the global population has been vaccinated. Countries that supplied the United States with shoes and clothes such as Vietnam have had factory hub shortages due to not having enough vaccinated workers.[source?]

In June 2022, BlackRock CEO Larry Fink argued that consumer demand in the United States had remained steady compared to pre-pandemic years, with supply-chain issues overseas being the primary cause of the post-pandemic inflation surge. He attributed this to some countries taking longer (than the U.S.) to resume economic activity, thereby disrupting international trade.[34]

Price gouging and windfall profits

In the United States, some Democratic politicians[35]: 1 [36]: 1 and other observers have contended that price gouging or “greedflation” exacerbated the inflation surge in the United States.[35]: 1 [37][38] They argue that the market concentration which has occurred in recent decades in some major industries, especially retailing, has given companies the ability to wield near-monopolistic pricing power.[38] Many economists responded by noting that if these large corporations indeed had so much market power, they could have used it to increase prices at any time, regardless of the pandemic.[38]

In 2022, several economists stated that price gouging could be a minor contributor to continuing inflation, but it is not one of the major underlying causes that started this surge.[35][37][38][36] Justin Wolfers, an economist at the University of Michigan quotes Jason Furman, who served as chair of the Council of Economic Advisers under President Obama said, “Blaming inflation on [corporate] greed is like blaming a plane crash on gravity. It is technically correct, but it entirely misses the point.”[39] Wolfers states that companies will always charge the highest prices possible, but that competition keeps prices in check.[39]

Economists have stated that during times of high inflation, consumers know prices are increasing but do not have a good understanding of what reasonable prices should be, giving retailers the opportunity to raise prices faster than the cost inflation they are experiencing, resulting in larger profits.[35]: 1 [37][38][40] One example of this was the meat industry, where profits went up industry-wide as prices went up, because demand never decreased.[41]

A 2021 analysis conducted by The New York Times found that profit margins across more than 2,000 publicly traded companies were well above the pre-pandemic average during the year, as corporate profits reached a record high.[42][43] Economists at the University of Massachusetts Amherst found that in 2022 profit margins of US companies reached their highest level since the aftermath of World War II.[44] European Central Bank economists found in May 2023 that businesses were using the surge as a rare opportunity to boost their profit margins, finding it was a bigger factor than rising wages in fueling inflation during the second half of 2022.[45]

UBS Global Wealth Management chief economist Paul Donovan said this has happened because post-pandemic household balance sheets have kept consumer spending demand strong enough to encourage producers to raise prices faster than costs, and because consumers have been gullible enough to find exaggerated narratives justifying such price hikes plausible: “Consumers seem to be buying stories that seem to justify price increases, but which really serve as cover for profit margin expansion.”[46]

In January 2023, the Federal Reserve Bank of Kansas City, released a study which stated that “…markup growth likely contributed more than 50 percent to inflation in 2021, a substantially higher contribution than during the preceding decade. However, the markup itself is determined by a host of unobservable factors, … We conclude that an increase in markups likely provides a signal that price setters expect persistent increases in their future costs of production.”[47]

Robert Reich, who worked under President Bill Clinton as Labor Secretary, stated, “Nobody believes that price gouging is the main cause of inflation…The question really is whether corporate pricing power is aggravating the situation. And there’s a great deal of evidence it is.”[36]

A 2022 Working Paper by the International Monetary Fund explores implementation of windfall profit taxes, which have gained renewed interest following the COVID-19 pandemic, the war in Ukraine, and subsequent surges in energy and food prices. The paper discusses the potential of such taxes as a tool for efficiently taxing economic rents, which are often a result of monopolistic power or unexpected events like pandemics, war, or natural disasters, and contribute to windfall profits. Such profits have raised public and policy concerns about price gouging, where firms are perceived to be profiting excessively from unforeseen circumstances.[48]

A May 2023 New York Times story reported that despite the costs of doing business falling in recent months, many large corporations have continued to raise prices, contributing to the recent inflation surge. The prices of oil, transportation, food ingredients, and other raw materials have decreased as the shocks from the pandemic and the Ukraine war have faded. However, many businesses have maintained or even increased their prices, bolstering their profits and potentially keeping inflation high. This strategy could pressure the Federal Reserve to keep raising interest rates, increasing the likelihood of an economic downturn. Analysts suggest that the continued high consumer prices are due to several factors, including increased demand for goods and services as households emerge from the pandemic, constrained supply chains, and consumers’ willingness to spend more due to government stimulus payments, investment gains, pay raises, and low-interest mortgage refinancing. One investment firm estimates that these spending habits may change this summer as the bottom 25% of income earners fully deplete their pandemic savings. Some economists warn that wealthier households are affected less by inflation, with higher prices encouraging poorer consumers to substitute for less expensive purchases.[49]

An International Monetary Fund study published in June 2023 found that rising corporate profits accounted for almost half of the increase in euro area inflation during the preceding two years.[50]

According to a 2023 article in The Economist, there has been a notable rise in market concentration across various sectors, leading to significantly higher profits for dominant firms, especially in Western economies. This trend has been linked to concerns about greed-fueled price increases, particularly in sectors like energy and healthcare where large firms have been able to collect substantial economic rents.[51]

A December 2023 paper published by the UK based Institute for Public Policy Research and Common Wealth think tanks stated that corporate profiteering played an important role in the inflation spike of 2022. Corporate profits surged while wages failed to keep pace with rising prices, resulting in the working class suffering the largest decline in disposable and discretionary income since World War II.[52]

In January 2024, the progressive think thank Groundwork Collaborative published a report in which it declared that “resounding evidence” shows that high corporate profits were responsible for 53% of inflation in the United States during the second and third quarters of 2023.[53]

Oil and gasoline sector

Shortly after initial energy price shocks caused by the Russian invasion of Ukraine subsided, oil companies found that supply chain constrictions, already exacerbated by the ongoing global COVID-19 pandemic, supported price inelasticity, i.e., they began lowering prices to match the price of oil when it fell much more slowly than they had increased their prices when costs rose.[54]

The major American and British oil producers (Big Oil) reported record profits in 2022.[55][56][57] Amid longstanding constraints in refinery capacity, refinery profit margins were higher than their historical averages.[58] In July, the UK imposed a 25% windfall profit tax on British North Sea oil producers, which expected to raise £5 billion to pay for a government scheme that reduced household energy costs.[59] In late October, U.S. President Joe Biden accused the oil and gas sector of “war profiteering” and threatened to seek a windfall profit tax if the industry did not increase production to curb gasoline prices.[60]

Also, some argued the possibility of a “base effect” phenomenon that emerged due to a significant decline in certain prices, such as oil, at the onset of the pandemic. Comparing these anomalously low prices with the subsequent higher prices has then accentuated the perceived inflation.[61][62]

Analysis published in June 2023 by the Bureau of Labor Statistics found that from February 2020 through May 2023, gasoline retailing profit margins had increased 62%.[63]

Grocery prices

Analysis published in early 2024 by the White House Council of Economic Advisers found that grocery and beverage retailers had increased their margins by nearly two percentage points since the eve of the pandemic, to the highest level in two decades. The analysis found that grocer margins had remained elevated as the inflation surge eased, though margins for other types of retailers had fallen back to historical levels. President Joe Biden and others asserted that shrinkflation, a practice of reducing portion or quantity sizes of packaged foods while maintaining the same price, was keeping profit margins higher than usual.[64][65][66]

The Federal Trade Commission released a report in March 2024 finding that large grocery retailers “accelerated and distorted” the effects of supply chain disruptions to protect their profits. The analysis found that some large retailers “seem to have used rising costs as an opportunity to further hike prices to increase their profits, and profits remain elevated even as supply chain pressures have eased.” The study found some large retailers sought to gain an advantage over smaller competitors by threatening suppliers with large fines if strict delivery requirements were not met, and that in some cases “suppliers preferentially allocated product to the purchasers threatening to fine them.” Some suppliers, however, were already contractually-bound to supply other retailers. FTC chair Lina Khan said “dominant firms used this moment to come out ahead at the expense of their competitors and the communities they serve.” Although the pace of grocery price increases had abated since the 2022 surge, prices had not since fallen overall by 2024. Retailers have said they planned smaller price increases in 2024 as consumers had begun to push back against high prices, causing some retailers to lose sales. The FTC and several state attorneys general in February 2024 sued to block a proposed $25 billion merger between large grocery chains Kroger and Albertsons, arguing the deal would reduce competition and likely lead to higher consumer prices.[67]

Industry consolidation driving inflation? – comparison to healthcare

The healthcare industry, which has become highly consolidated over previous decades like the oil industry, and has until recently had prices continuously rising faster than inflation, has not experienced recent price inflation, whereas the oil industry has.[35]: 1 [38]: 1

Motor vehicle prices

In the United States, higher motor vehicle prices were a significant contributor to the inflation surge. Analysis published in May 2023 by The New York Times found that auto manufacturers and dealers shifted from a high volume-low margin business model before the pandemic to a low volume-high margin model after the pandemic. Manufacturers emphasized higher-margin luxury vehicles, while dealers increased their markups over manufacturer list prices. A study published by the Bureau of Labor Statistics, the agency that tracks consumer prices, found that dealer markups accounted for 35% to 62% of new vehicle inflation from 2019 to 2022. Paul Ryan, the CEO of a shopping app that monitors prices across about 40,000 dealerships, remarked, “it was the best of times for car dealers, for sure.”[68]

Transitory vs persistent debate

A debate arose among economists early in 2021 as to whether inflation was a transitory effect of the world’s emergence from the pandemic, or whether it would be persistent. Economists Larry Summers and Olivier Blanchard warned of persistent inflation, while Paul Krugman and U.S. Treasury Secretary Janet Yellen argued it would be transitory.[69] Inflation continued to accelerate during 2021 and into 2022. In response, the Federal Reserve increased the fed funds rate by 25 basis points in March 2022, the first increase in three years, followed by 50 basis points in May, then a succession of four 75 basis point hikes in each of June, July, September and November. Some analysts considered these increases late and dramatic, arguing they might induce a recession.[70][71] The combined moves put the fed funds rate at its highest level[quantify] since the onset of the Great Recession in early 2008.[72][73] Inflation in the Eurozone hit a record high of 8.1% in May, prompting the European Central Bank to announce that it would raise rates in July by 25 basis points, the first increase in eleven years, and again in September by 50 basis points. By November it had increased rates by a cumulative 200 basis points.[74][75] After the Fed’s third rate increase, Summers said “We are still headed for a pretty hard landing.”[76] By November 2022, the inflation rate in the United States had declined five months straight while job creation remained strong and third quarter real GDP growth was 3.2% on strong consumer spending, leading a growing number of investors to conclude a hard landing might be averted.[77][78][79][80]

Impact of the 2022 Russian invasion of Ukraine

Mark Zandi, chief economist of Moody’s Analytics, analyzed United States Consumer Price Index components following the May 2022 report that showed an 8.6% inflation rate in the U.S. He found that by then the 2022 Russian invasion of Ukraine was the principal cause of higher inflation, comprising 3.5% of the 8.6%. He said oil and commodities prices jumped in anticipation of and response to the invasion, leading to higher gasoline prices. Resulting higher diesel prices led to higher transportation costs for consumer goods, notably food.[81]

Russian gas supply curbs, which began in 2021, aggravated energy crunch caused by demand growth and global supply limitations during the post pandemic restrictions recovery. In Europe, gas prices increased by more than 450%, and electricity by 230% in less than a year.[82] On February 22, 2022, before the Russian invasion, the German Government froze the Nord Stream 2 pipeline between Russia and Germany,[83] causing natural gas prices to rise significantly.[84]

On February 24, Russian military forces invaded Ukraine[85] to overthrow the democratically elected government, and replace it with a Russian puppet government.[86] Before the invasion, Ukraine accounted for 11.5% of the world’s wheat crop market, and contributed 17% of the world’s corn crop export market, and the invasion caused wheat and corn from Ukraine unable to reach international market, causing shortages, and result in dramatic rise in prices,[87] that exacerbated to foodstuffs and biodiesel prices.[88][89] Additionally, the price of Brent Crude Oil per barrel rose from $97.93 on February 25 to a high of $127.98 on March 8,[90] this caused petrochemicals and other goods reliant on crude oil to rise in price as well.[91][92]

The effect of sanctions on the Russian economy caused annual inflation in Russia to rise to 17.89%, its highest since 2002.[93] Weekly inflation hit a high of 0.99% in the week of April 8, bringing YTD inflation in Russia to 10.83%, compared to 2.72% in the same period of 2021.[93]

Regional impacts

While most countries saw a rise in their annual inflation rate during 2021 and 2022, some of the highest rates of increase have been in Europe, Brazil, Turkey and the United States.[94][95] By June 2022, nearly half of Eurozone countries had double-digit inflation, and the region reached an average inflation rate of 8.6%, the highest since its formation in 1999.[96] In response, at least 75 central banks around the world have aggressively increased interest rates.[97] However, the World Bank warns that combating inflation with rate hikes has increased the risk of a global recession.[98][99]

North Africa and Middle East

Countries in North Africa were disproportionally affected by inflation. Tunisia went through a crisis triggered by soaring energy prices and unprecedented inflation of foods in 2022. Moroccan household finances also were negatively affected by imported inflation. Annual inflation rates in North African countries rose to 15.3 percent compared to 6.4 percent in 2021, according to the Central Agency for Public Mobilization and Statistics.[100][101][102]

In some North African countries, the inflation surge has encouraged hoarding practices by consumers. Price increases for basic food staples, such as coffee, were particularly high in parts of Asia and North Africa, where people spend a higher proportion of income on food and fuel than in the United States and Europe. Food producers of Nestlé‘s Middle East and North Africa (MENA) unit have noticed the stock-piling of non-perishable items, as a reaction to the surging inflation. Karim Al Bitar, head of consumer research and market intelligence at MENA, said that the company is considering to make some products “more affordable” to consumers.[103]

In Turkey, retail prices rose 9.65% in December compared to November, for an annual rate of 34%. Some of the largest increases were for electricity, natural gas, and gasoline. The economy was further strained by a currency crisis caused by a series of rate cuts by the central bank; the Turkish lira lost 44% of its value against the dollar during 2021.[104] By August 2022, Turkey’s inflation rate was 80.21%.[105]

Sub-Saharan Africa

According to the IMF, median inflation approached 9% in August. Rising prices of food and “tradable goods like household products” have contributed most to this increase.[106]

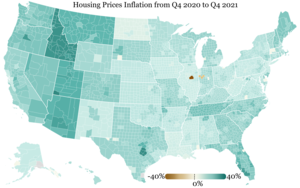

North America

40% 20% 0% -20% -40%

In the United States, the Consumer Price Index rose 6.8% between November 2020 and November 2021, spurred by price increases for gasoline, food, and housing.[107] Higher energy costs caused the inflation to rise further in 2022,[108] reaching 9.1%, a high not seen since 1981.[109] In July 2022, the Fed increased the interest rate for the third time in the year,[110] yet inflation remained high outpacing the growth in wages[111] and spending.[112] According to the Economic Policy Institute the minimum wage was worth less than any time since 1956 due to inflation.[113][114]

Nevertheless, the hikes were seen as faster and sooner than the response by the European Central Bank, so while the euro fell, the dollar remained relatively stronger, helping it to be the more valuable currency for the first time in 20 years.[115][116] On July 27, the Fed announced a fourth rate rise by 0.75 points, bringing the rate to a range between 2.25% and 2.5%; although an expected move to combat the inflation, the rise has been seen more cautiously as there are signs that the economy is entering a recession, which the rate rises could potentially aggravate.[117][118][119] On July 28, data from the BEA showed that the economy shrunk for the second quarter in a row, which is commonly used to define a recession.[120][121][122] BLS data showed that inflation eased on July to 8.5%[123][124] from the 40-year peak reached in June at 8.9%.[125] Annual inflation increased to 8.3% in August 2022, in part due to rising grocery prices.[126] In September, the Fed increased the interest for a fifth time in the year reaching a 14-year high.[127] In November 2022, the year-over-year inflation rate was 7.1%, the lowest it has been since December 2021 but still much higher than average.[128]

Inflation is believed to have played a major role in a decline in the approval rating of President Joe Biden, who took office in January 2021, being net negative starting in October of that year.[129] Many Republicans have blamed stimulus spending by Biden and fellow Democrats for fueling the surge; economists argue that the government’s COVID stimulus during 2020 under Trump, as well as the Federal reserve’s actions, and more stimulus under Biden, started the 2021 inflation spike.[130] In March 2023, Federal Reserve chairman Jerome Powell said that currently the primary drivers of inflation are supply chain problems, consumers’ change to purchases of goods rather than services, and the tight labor market.[130][131]

A recent analysis by the Federal Reserve Bank of Kansas City ascertained the role America is playing in the current inflationary trend worldwide. Before 2019, the U.S. was seen as a last resort for consumer spending during a global recession, but after 2020, U.S. exports have contributed to foreign inflation. At the same time, energy prices have gone up as well as the value of the U.S. dollar, which both increased monetary pressures on nations that mostly rely on energy imports. In effect, the strength of the U.S. dollar and sanctions on energy commodities have contributed to global inflation in 2022.[132]

Analysis conducted by Politico in May 2023 found that in the United States, wage growth for the bottom 10th percentile of the wage scale beat inflation by a strong 5.7% from 2020 through 2022. For the middle 50th percentile, real wages were down by 1%, while they were down 5% for the top 90th percentile.[133]

After peaking at 9.1% in June 2022, the United States inflation rate declined steadily into 2023, representing overall disinflation. Analysis conducted by NerdWallet on October 2023 data found that prices for 92 of the 338 goods and services measured in CPI had declined from one year earlier, representing deflation for those items.[134] The Farm Bureau annual survey found the average cost of a Thanksgiving dinner would be down 4.5% from 2022.[135]

On July 26, the FED raised the interest rate to 5.5% the highest since 2001[136] and in October the 10-year Treasury yield rose to 5% a 16 year high.[137][138] while the 30-year fixed mortgage rate rose to 8% a 23 year high.[139] 2023 was the worst year for US home sales since 1995.[140] Despite gloom numbers the US defied recession fears with 3.3% growth in fourth quarter.[141][142]

Canada also saw multi-decade highs in inflation, hitting 5.1% in February 2022[143] and further increasing to 6.7% two months later.[144] In April, inflation rose again to 6.8%,[145][146] before jumping to 7.7% in May, the highest ever since 1983.[147][148]

In July 2022, Mexico’s INEGI reported a year-on-year increase in consumer prices of 8.15%, against a Central Bank target of 2–4%.[149]

As of April 2024, the annual inflation rate in the United States was 3.5% for the twelve months ending in March, compared to 7% in 2021 and 6.5% in 2022.[150][151][152]

South America

In Brazil, inflation hit its highest rate since 2003 — prices rose 10.74% in November 2021 compared to November 2020. Economists predicted that inflation has peaked and that, in fact, the economy may be headed for recession, in part due to aggressive interest rate increases by the central bank.[153]

According to Austing Rating data, Brazil ended 2022 with the sixth lowest G20 inflation rate. Inflation recorded in Brazil in 2022 was below the United States for the first time in 15 years, in addition to being lower than that of the United Kingdom and the 6th lowest in the G20 (group of the 19 largest and most important economies in the world and the European Union).[154]

In Argentina, a country with a chronic inflation problem, the interest rate was hiked to 69.5% in August, as inflation has further deteriorated hitting a 20-year high at 70%, and is forecasted to top 90% by the end of the year.[155] Inflation hit past 100% in February 2023 for the first time since 1991.[156][157] Argentina’s December 2023 annual inflation was the highest in the world at 211.4%.[158]

Chile had low inflation for several years thanks to the monetary policy of its autonomous central bank. However, in 2022 there was a record intranual inflation of 14.1%, the highest in the last 30 years. There is a consensus among economists that Chilean inflation is mainly caused by endogenous factors, especially the aggressive expansionary policies during the COVID-19 pandemic and the massive withdrawals from pension funds. Economists have also predicted a possible recession by 2023 due to high interest rates to combat inflation.[159][160]

Europe

In the Netherlands, the average 2021 inflation rate was the highest since 2003.[161] With energy prices having increased by 75%, December saw the highest inflation rate in decades.[161] In 2023, Netherlands fell into recession from April to June.[162]

In the UK, inflation reached a 40-year high of 10.1% in July 2022, driven by food prices, and further increase is anticipated in October when higher energy bills are expected to hit.[163] In September, the Bank of England warned the UK may already be in recession[164] and in December, the interest rate was raised by the ninth time in the year to 3.5%, the highest level for 14 years.[165]

UK food and drink prices rose by 19.2% in the year to March 2023, a 45-year high.[166][167] On 3 August the BoE raised the interest rate to 5.25%, the highest since 2008.[168] The UK entered a technical recession in the final six months of 2023.[169][170]

Germany’s inflation rate reached 11.7% in October, the highest level since 1951.[171] In 2023, Germany fell into recession from January to March due to persistent inflation.[172]

In France, inflation reached 5.8% in May, the highest in more than three decades.[173]

An estimated 70,000 people protested against the Czech government as a result of rising energy prices.[174][175]

In June 2022, the European Central Bank (ECB) decided to raise interest rates for the first time in eleven years due to the elevated inflation pressure.[176][177] In July, the euro fell below the U.S. dollar for the first time in 20 years, mainly due to fears of energy supply restrictions from Russia, but also because the ECB lagged behind the US, UK and other central banks in raising interest rates.[115][116] Eurozone inflation hit 9.1% and 10% in August and September, respectively,[178][179] prompting the ECB to raise interest rates for a second time in the year to 1.25% in early September.[180] In October, the inflation hit 10.7%, the highest since records began in 1997.[181][171]

In 2023, the Eurozone fell into recession from January to March[182] and also in March, the Eurozone core inflation hit a record 5.7%, the highest level since records began in 2001.[183] On 14 September, the ECB raised the interest rate for the tenth consecutive time to 4%, the highest since the euro was launched in 1999.[184][185]

Asia

In April 2022, the Philippines recorded 6.1% inflation, its highest since October 2018. The Philippine Statistics Authority forecasted that the number would most likely be higher in the following months. President Bongbong Marcos claimed that the record inflation rate was “not that high”.[186] On January 5, 2023, the Philippines rapidly increased to a record-breaking 8.1% inflation from December 2022.[187][188]

In October 2022, the Japanese yen touched a 32-year low against the U.S. dollar, mainly because of the strength of the latter.[189][190] In November, the Japanese core inflation rate reached a 41-year high of 3.7%.[191]

Oceania

Inflation in New Zealand exceeded forecasts in July 2022, reaching 7.3%, which is the highest since 1990.[192] Economists at ANZ reportedly said they expected faster interest rate increases to counteract inflationary pressures.[193]

In Fiji, inflation rose to 4.7% in April 2022 compared to –2.4% in 2021.[194] Food prices rose by 6.9% in April 2022, fuel increased by 25.2%, kerosene by 28.5% and gas by 27.7%.[195]

In November 2023, Australia lifted the interest rate to 4.35%, a 12-year high.[196]

Inflation perceptions

An April 2024 Wall Street Journal poll across seven political swing states in the United States found that 74% of respondents thought inflation had worsened over the preceding year, though the inflation rate had declined by nearly half from one year earlier. On net, respondents in every state said the economy had improved in their state over the past two years, though they believed the national economy had worsened.[197] Numerous surveys showed that respondents considered inflation the single most important indicator of economic performance, and that consumers were more likely to perceive inflation as price levels rather than the pace of price increases.[198] The Federal Reserve February 2024 Survey of Consumer Expectations found that consumers had a median expectation of a 3.0% inflation rate in the coming year, and 2.7% over a three-year time horizon.[199]

See also

References

- ^ “World Economic Outlook database: October 2023”. International Monetary Fund. October 2023. Retrieved February 10, 2024.

- ^ “World Development Indicators – Databank”. The World Bank. Retrieved February 10, 2024. [For regions]

- ^ Winters, Mike (October 12, 2023). “Don’t expect prices to go down soon: It will take a while to ‘wring extra inflation out of the economy,’ says economist”. CNBC. Retrieved March 29, 2024.

- ^ Stewart, Emily (November 8, 2023). “The problem isn’t inflation. It’s prices”. Vox. Retrieved March 29, 2024.

Prices tend to be “downwardly rigid,” [Mike Konczal, director of macroeconomic analysis at the Roosevelt Institute] added, meaning they tend not to go down (the same goes for wages).

- ^ Rugaber, Christopher (January 24, 2024). “Americans’ economic outlook brightens as inflation slows and wages outpace prices”. PBS Newshour.

Even with the steady slowdown in inflation, prices are still nearly 17 percent higher than they were three years ago, a source of discontent for many Americans. Though some individual goods are becoming less expensive, overall prices will likely remain well above their pre-pandemic levels. … Many Americans might still favor having the government take steps not only to slow inflation but also to try to reduce overall prices to where they were before the pandemic. … Economists, though, uniformly caution that any attempt to do so would require a significant weakening of the economy, resulting from either sharp interest rate hikes by the Fed or tax increases. The likely consequence could be a recession that would cost millions of jobs. David Andolfatto, an economist at the University of Miami and a former Fed economist, said it is better for wages to rise over time to allow people to adjust to higher prices.

- ^ Rugaber, Christopher (November 19, 2023). “Why Americans feel gloomy about the economy despite falling inflation and low unemployment”. AP NEWS.

Most Americans,” Cook said, “are not just looking for disinflation” — a slowdown in price increases. “They’re looking for deflation. They want these prices to be back where they were before the pandemic. … I hear that from my family.” … Deflation — a widespread drop in prices — typically makes people and companies reluctant to spend and therefore isn’t desirable. Instead, economists say, the goal is for wages to rise faster than prices so that consumers still come out ahead.

- ^ Multiple sources:

- Santul Nerkar; Amelia Thomson-DeVeaux (April 26, 2022). “Were The Stimulus Checks A Mistake?”. FiveThirtyEight.

- Gharehgozli, O.; Lee, S. (2022). “Money Supply and Inflation after COVID-19”. Economies. 10 (5): 101. doi:10.3390/economies10050101.

- Van Dam, Andrew (January 13, 2022). “2021 shattered job market records, but it’s not as good as it looks”. The Washington Post. Archived from the original on April 15, 2022.[better source needed]

- Lynch, David (October 9, 2022). “Biden’s rescue plan made inflation worse but the economy better”. The Washington Post.

- ^ Nagata, Kazuaki (March 19, 2024). “BOJ introduces first rate hike in 17 years following pay gains”. The Japan Times. Retrieved April 3, 2024.

- ^ Weber, Alexander (February 2, 2022). “Euro-Zone Inflation Unexpectedly Hits Record, Boosting Rate Bets”. Bloomberg. Archived from the original on February 12, 2022.

- ^ “India’s Dec WPI inflation at 13.56% as firms fight rising costs”. Reuters. January 14, 2022. Archived from the original on February 12, 2022.

- ^ Kihara, Leika (January 14, 2022). “Japan’s wholesale inflation at near record high on broad price gains”. Reuters. Archived from the original on February 12, 2022.

- ^ Christopher Rugaber (July 13, 2022). “As the causes of US inflation grow, so do the dangers”. Associated Press.

- ^ a b c Kalish, Ira; Wolf, Michael (February 18, 2022). “Global surge in inflation”. Deloitte. Archived from the original on June 20, 2022.

- ^ “Rising costs: How emerging economies are being affected by inflation”. World Economic Forum. February 23, 2022. Archived from the original on June 16, 2022.

- ^ Surowiecki, James (June 10, 2022). “How Did They Get Inflation So Wrong?” The Atlantic. Accessed 24 March 2023.

- ^ “How Food and Energy are Driving the Global Inflation Surge” imf.org. Accessed 24 March 2023.

- ^ a b c Bank, European Investment (October 12, 2023). EIB Investment Survey 2023 – European Union overview. European Investment Bank. ISBN 978-92-861-5609-0.

- ^ “Study on Energy Prices, Costs and Subsidies and their Impact on Industry and Households” (PDF).

- ^ Sante, Gerben Hieminga, Maurice van. “The sectors most affected by soaring energy prices”. ING Think. Retrieved October 24, 2023.

{{cite web}}: CS1 maint: multiple names: authors list (link) - ^ “World Energy Transitions Outlook 2022”. www.irena.org. Retrieved October 24, 2023.

- ^ “Policy Responses to COVID19”. IMF. Retrieved October 18, 2022.

- ^ Levitz, Eric (May 15, 2020). “We’re Paying for Coronavirus Stimulus by Printing Money. And That’s Fine!”. New York. Retrieved June 27, 2023.

- ^ Ron Surz. “Money Printing and Inflation: COVID, Cryptocurrencies and More”. Nasdaq.

- ^ “Nigeria: Inflation – Money Supply Hits N46.5 Trn, Clickbait 5 Years”. Allafrica.com. Gale Academic OneFile. June 13, 2022.

- ^ “Contractionary Monetary Policy”. Corporate Finance Institute. Retrieved November 14, 2022.

- ^ Josh Boak; Paul Wiseman (August 13, 2023). “Yes, inflation is down. No, the Inflation Reduction Act doesn’t deserve the credit”. Associated Press.

- ^ “How the supply chain caused current inflation, and why it might be here to stay”. PBS NewsHour. November 10, 2021. Retrieved August 26, 2022.

- ^ Austin, Craig (November 10, 2021). “How the supply chain caused current inflation, and why it might be here to stay”. PBS. Archived from the original on January 3, 2022.

- ^ *Van Dam, Andrew (January 13, 2022). “2021 shattered job market records, but it’s not as good as it looks”. The Washington Post. Archived from the original on April 15, 2022.

- Jason Furman; Wilson Powell III (January 28, 2022). “US wages grew at fastest pace in decades in 2021, but prices grew even more”. Petersen Institute for International Economics. Archived from the original on June 6, 2022.

- ^ Sherman, Natalie (June 14, 2022). “Why is inflation in US higher than elsewhere?”. BBC News. Retrieved June 14, 2022.

- ^ Jordà, Òscar; Liu, Celeste; Nechio, Fernanda; Rivera-Reyes, Fabián (March 28, 2022). “Why Is U.S. Inflation Higher than in Other Countries?”. Federal Reserve Bank of San Francisco.

- ^ “How the supply chain caused current inflation, and why it might be here to stay”. PBS NewsHour. November 10, 2021. Retrieved November 14, 2022.

- ^ “Record Breaking Increases in Motor Fuel Prices in 2022 | Bureau of Transportation Statistics”. www.bts.gov. Retrieved November 14, 2022.

- ^ BlackRock CEO Larry Fink on Inflation, ESG Investing, retrieved October 17, 2022

- ^ a b c d e Lopez, German (June 14, 2022). “Inflation and Price Gouging – We look at whether “greedflation” is causing higher prices”. The New York Times. Archived from the original on June 25, 2022.

But inflation gives greedy, monopolistic companies a chance to take advantage, said Lindsay Owens, the executive director of the left-leaning Groundwork Collaborative. Profiteering “is an accelerant of price increases,” she told me. “It is not the primary cause.” … More recent developments have also weakened the greedflation theory. Inflation has remained high … But the stock market has plummeted; … If the pursuit of profits were driving more inflation, you would not expect to see that.

- ^ a b c Smith, Molly; Wasson, Erik (May 19, 2022). “Democrats’ ‘Greedflation’ Claims Run Up Against Scant Evidence – Some Democrats accuse companies of bilking US consumers”. Bloomberg News.

Many Democrats blame price-gouging companies for the worst surge in Americans’ cost of living in more than a generation. But economists, including several who are left-leaning, disagree.

- ^ a b c Brooks, Khristopher J. (May 27, 2022). “Companies use inflation to hike prices and generate huge profits, report says”. CBS News. Archived from the original on June 25, 2022.

Some of the nation’s largest retailers have been using soaring inflation rates as an excuse to raise prices and rake in billions of dollars in additional profit, a corporate watchdog group charged on Friday. … The report highlights an ongoing debate about the causes of inflation, with some consumer advocates arguing that corporations are using inflation as a justification for passing on even higher price hikes to consumers. … To be sure, inflation is rising sharply due to a number of underlying economic issues, such as supply-chain bottlenecks, labor shortages and strong demand from consumers.

- ^ a b c d e f DePillis, Lydia (June 3, 2022). “Is ‘Greedflation’ Rewriting Economics, or Do Old Rules Still Apply?”. The New York Times. Archived from the original on June 25, 2022.

When thinking about greedflation, it’s helpful to break it down into three questions: Are companies charging more than necessary to cover their rising costs? If so, is that enough to meaningfully accelerate inflation? And is all this happening because large companies have market power they didn’t decades ago? … There is not much disagreement that many companies have marked up goods in excess of their own rising costs. … When all prices are rising, consumers lose track of how much is reasonable to pay. … But most of the public argument has been about whether companies with more market share have been affecting prices once goods are finished and delivered. And that’s where many economists become skeptical, noting that if these increasingly powerful corporations had so much leverage, they would have used it before the pandemic.

- ^ a b Vanek Smith, Stacy (November 29, 2022). “The mystery of rising prices. Are greedy corporations to blame for inflation?”. NPR.

Wolfers says companies are always trying to charge as much as they possibly can. In fact, the only reason we’re not all paying $800 for a pair of socks or a cheeseburger is simply due to greed in another form: competition. … “Inflation is coming from demand,” says Wolfers. In spite of inflation, demand hasn’t really blinked. Companies have been raising prices and we have been paying them. In fact, in many parts of the economy, spending has been rising right along with prices. … And when our buying slows down, Wolfers says, companies will start lowering prices to entice us to buy: Prices will fall and inflation will ease. But, until demand drops, companies will push prices up as much as they can. It’s elementary.

- ^ Inman, Phillip (March 24, 2023). “Greedflation: are large firms using crises as cover to push up their profits?”. The Guardian.

Andrew Bailey, the Bank of England governor, says he has no evidence that excessive profits are pushing up inflation beyond where it would be if companies simply passed on extra costs to consumers, … Albert Edwards, a senior analyst at Société Générale, … “Companies [have] under the cover of recent crises, pushed margins higher,” he said in a note. “And, most surprisingly, they still continue to do so, even as their raw material costs fall away. Consumers are still ‘tolerating’ this ‘excuseflation’, possibly because excess [government] largesse has provided households with a buffer. … Isabella Weber, an economist at the University of Massachusetts Amherst, has shown which kinds of companies are able to benefit from a crisis, giving academic support for what she considers a rational capitalist reaction to a crisis, one that allows them to make even bigger profits when consumers are primed to expect prices to rise in leaps and bounds.

- ^ Bojorquez, Manuel (March 9, 2022). “Inflation or “corporate greed”? Meat prices increased by double digits during pandemic”. CBS news.

According to quarterly reports for Tyson, the nation’s largest meat processor, the company posted $3 billion in profit in 2021. … Other major meat suppliers are also posting similar profits. Some analysts like Salvador believe the numbers don’t add up. … But what we see at the same time is that their profitability has been able to increase because the demand increases for their products have more than offset their cost increases. … Salvador said there is nothing to keep the prices from increasing as long as “there isn’t competition that will help drive down the prices so that they have a reason to actually be more reasonable.”

- ^ Eavis, Peter; Talmon, Joseph Smith (May 31, 2022). “After a Bumper 2021, Companies Might Struggle to Increase Profits – Businesses face headwinds as demand weakens, the Federal Reserve raises rates and government stimulus programs end”. New York Times.

A New York Times analysis of over 2,000 publicly traded companies outside the financial sector found that most of them increased sales faster than expenses, a remarkable feat when the cost of wages, raw materials and components was rising and supply chains were out of whack. As a result, profit margins, which measure how much money a business makes on each dollar of sales, rose well above the prepandemic average. On the whole, companies made an estimated $200 billion in additional operating profits last year because of that increase in margins.

- ^ Phillips, Matt (March 31, 2022). “Corporate profits hit a new record high in 2021”. Axios.

- ^ Martin Arnold; Patricia Nilsson; Colby Smith; Delphine Strauss (March 29, 2023). “Central bankers warn companies on fatter profit margins”. Financial Times.

- ^ Hannon, Paul (May 3, 2023). “Why Is Inflation So Sticky? It Could Be Corporate Profits”. The Wall Street Journal.

Inflation has proved more stubborn than central banks bargained for when prices started surging two years ago. Now some economists think they know why: Businesses are using a rare opportunity to boost their profit margins…According to economists at the ECB, businesses have been padding their profits. That, they said, was a bigger factor in fuelling inflation during the second half of last year than rising wages were

- ^ Donovan, Paul (November 2, 2022). “Fed should make clear that rising profit margins are spurring inflation”. Financial Times. Retrieved February 12, 2023.

- ^ Glover, Andrew; Mustre-del-Río, José; von Ende-Becker, Alice (January 12, 2023). “How Much Have Record Corporate Profits Contributed to Recent Inflation? – Firms raised markups during 2021 in anticipation of future cost pressures, contributing substantially to inflation” (PDF). The Federal Reserve Bank of Kansas City Economic Review. doi:10.18651/er/v108n1glovermustredelriovonendebecker. ISSN 0161-2387. S2CID 256654064.

- ^ Hebous, Shafik; Prihardini, Dinar; Vernon, Nate (2022). “Excess Profit Taxes: Historical Perspective and Contemporary Relevance”. IMF Working Papers. 2022 (187): 1. doi:10.5089/9798400221729.001. Retrieved December 12, 2023.

- ^ Smith, Talmon Joseph; Rennison, Joe (May 30, 2023). “Companies Push Prices Higher, Protecting Profits but Adding to Inflation”. The New York Times. Retrieved May 31, 2023.

- ^ Niels-Jakob Hansen; Frederik Toscani; Jing Zhou (June 26, 2023). “Europe’s Inflation Outlook Depends on How Corporate Profits Absorb Wage Gains”. International Monetary Fund.

As the Chart of the Week shows, the higher inflation so far mainly reflects higher profits and import prices, with profits accounting for 45 percent of price rises since the start of 2022. That’s according to our new paper, which breaks down inflation, as measured by the consumption deflator, into labor costs, import costs, taxes, and profits. Import costs accounted for about 40 percent of inflation, while labor costs accounted for 25 percent. Taxes had a slightly deflationary impact.

- ^ “Is big business really getting too big?”. The Economist. July 12, 2023. Archived from the original on July 16, 2023. Retrieved December 12, 2023.

- ^ Inman, Phillip (December 7, 2023). “Greedflation: corporate profiteering ‘significantly’ boosted global prices, study shows”. The Guardian. Retrieved January 6, 2024.

- ^ Perkins, Tom (January 19, 2024). “Half of recent US inflation due to high corporate profits, report finds”. The Guardian. Retrieved January 26, 2024.

The report, compiled by the progressive Groundwork Collaborative thinktank, found corporate profits accounted for about 53% of inflation during last year’s second and third quarters. Profits drove just 11% of price growth in the 40 years prior to the pandemic, according to the report.

- ^ Cronin, Brittany (May 7, 2022). “The good times are rolling for Big Oil. 3 things to know about their surging profits”. NPR. Archived from the original on May 21, 2022. Retrieved May 25, 2022.

- ^ Bussewitz, Cathy (July 29, 2022). “Unprecedented profit for major oil drillers as prices soared”. Associated Press.

- ^ Simonetti, Isabella (July 29, 2022). “Exxon and Chevron Report Record Profits on High Oil and Gas Prices”. The New York TImes.

- ^ Klauss, Clifford (October 28, 2022). “Oil Giants, With Billions in Profits, Face Criticism and an Uncertain Outlook”. The New York TImes.

- ^ Sanicola, Laura (July 14, 2022). “U.S. gasoline prices are finally falling. Why?”. Reuters.

- ^ “UK lawmakers approve windfall tax on oil and gas producers”. Reuters. July 11, 2022.

- ^ Baker, Peter (October 31, 2022). “Biden Accuses Oil Companies of ‘War Profiteering’ and Threatens Windfall Tax”. The New York TImes.

- ^ Koester, Gerrit; Lis, Eliza; Nickel, Christiane (2022). “Inflation Developments in the Euro Area Since the Onset of the Pandemic”. Intereconomics. 2022 (2): 69–75.

- ^ Van Doorslaer, Hielke; Vermeiren, Mattias (September 3, 2021). “Pushing on a String: Monetary Policy, Growth Models and the Persistence of Low Inflation in Advanced Capitalism”. New Political Economy. 26 (5): 797–816. doi:10.1080/13563467.2020.1858774. ISSN 1356-3467. S2CID 230588698.

- ^ Newman, Rick (July 25, 2023). “High profit margins on gasoline are costing drivers more”. Yahoo Finance.

- ^ Tankersley, Jim (February 1, 2024). “Biden Takes Aim at Grocery Chains Over Food Prices”. The New York Times.

- ^ “The costly economic trend here to stay”. BBC. September 24, 2023.

- ^ Kaplan, Juliana (December 17, 2023). “The 10 products that have shrunk the most under shrinkflation”. Business Insider.

- ^ Ngo, Madeleine (March 21, 2024). “Large Grocers Took Advantage of Pandemic Supply Chain Disruptions, F.T.C. Finds”. The New York Times.

- ^ Lydia DePillis; Jeanna Smialek (May 20, 2023). “Why Is Inflation So Stubborn? Cars Are Part of the Answer”. The New York Times.

- ^ Paul Krugman (December 16, 2021). “The Year of Inflation Infamy”. The New York Times.

- ^ Cox, Jeff (May 16, 2022). “Bernanke says the Fed’s slow response to inflation ‘was a mistake’“. CNBC.

- ^ Rachel Siegel; Emily Wright (November 2, 2022). “How the Fed’s rate hikes slow the economy — and impact you”. The Washington Post.

- ^ Timiraos, Nick (November 2, 2022). “Fed Approves Fourth 0.75-Point Rate Rise, Hints at Smaller Hikes”. The Wall Street Journal.

- ^ Smialek, Jeanna (July 27, 2022). “The Fed raises rates by three-quarters of a percentage point”. The New York TImes.

- ^ Amaro, Silvia (July 21, 2022). “European Central Bank surprises markets with larger-than-expected rate hike, its first in 11 years”. CNBC.

- ^ “ECB must keep raising rates even if recession risks rise, Lagarde says”. Reuters. November 1, 2022.

- ^ Multiple sources:

- Cox, Jeff (March 16, 2022). “Federal Reserve approves first interest rate hike in more than three years, sees six more ahead”. CNBC. Archived from the original on June 16, 2022.

- Cox, Jeff (May 4, 2022). “Fed raises rates by half a percentage point — the biggest hike in two decades — to fight inflation”. CNBC. Archived from the original on June 19, 2022.

- Cox, Jeff (June 15, 2022). “Fed hikes its benchmark interest rate by 0.75 percentage point, the biggest increase since 1994”. CNBC. Archived from the original on June 19, 2022.

- Megan Greene (January 7, 2022). “Betting on transitory US inflation is still valid”. Financial Times. Archived from the original on June 19, 2022.

- Beilfuss, Lisa (June 17, 2022). “‘We Are Still Headed for a Pretty Hard Landing,’ Ex-Treasury Secretary Larry Summers Says”. Barron’s. Archived from the original on June 19, 2022.

- Ben White (June 17, 2022). “Inflation’s main culprit? CEOs zero in on Powell’s Fed”. Politico. Archived from the original on June 19, 2022.

- “Europe’s central bank to hike rates in July, 1st in 11 years”. Associated Press. June 9, 2022. Archived from the original on June 19, 2022.

- Collinson, Stephen (June 1, 2022). “Yellen’s words on inflation won’t end America’s price hikes”. CNN. Archived from the original on June 19, 2022.

- ^ Wallace, Alicia (December 13, 2022). “Inflation cooled more than expected in November”. CNN.

- ^ Lydia DePhillis (December 2, 2022). “U.S. Job Growth Remains Strong, Defying Fed’s Rate Strategy”. The New York TImes.

- ^ Chris Isidore; Alicia Wallace (December 22, 2022). “The US economy grew much faster than previously thought in the third quarter”. CNN.

- ^ Otani, Akane (December 11, 2022). “Investors Grow More Confident Fed Will Pull Off a Soft Landing”. The Wall Street Journal.

A few months ago, Wall Street rebuffed the idea that the Federal Reserve would be able to pull off a soft landing. Now, a growing crowd is betting on exactly that happening. Mutual funds and hedge funds managing roughly $4.8 trillion in assets have been putting money into stocks that stand to benefit from inflation cooling, interest rates going down and the U.S. economy avoiding a recession, according to an analysis by Goldman Sachs Group Inc.