Summary

Mission: The committee focuses on matters relating to taxation and other revenue measures generally, and those relating to the insular possessions; bonded debt of the United States; customs, collection districts, and ports of entry and delivery; deposit of public moneys; general revenue sharing; health programs under the Social Security Act (notably Medicare and Medicaid) and health programs financed by a specific tax or trust fund; national social security; reciprocal trade agreements; tariff and import quotas, and related matters thereto; and the transportation of dutiable goods.

House counterpart: Ways and Means Committee

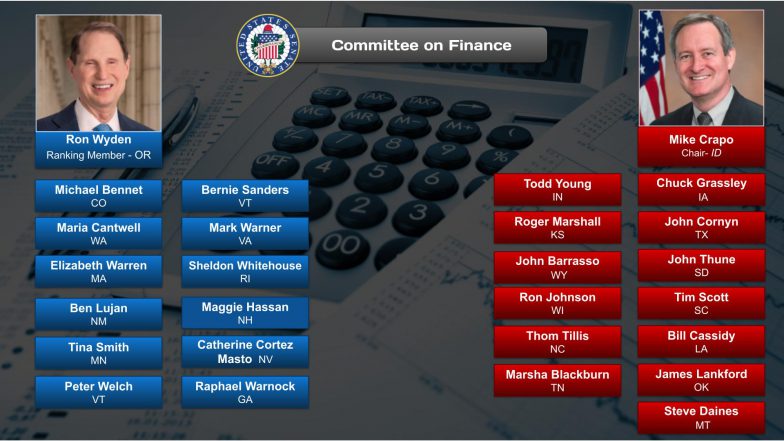

Democratic Members (Minority):

Ron Wyden, Oregon, Ranking Member

Maria Cantwell, Washington

Michael Bennet, Colorado

Mark Warner, Virginia

Sheldon Whitehouse, Rhode Island

Maggie Hassan, New Hampshire

Catherine Cortez Masto, Nevada

Elizabeth Warren, Massachusetts

Bernie Sanders, Vermont

Ben Luján, New Mexico

Raphael Warnock, Georgia

Peter Welch, Vermont

Republican Members (Majority):

Mike Crapo, Idaho, Chair

Chuck Grassley, Iowa

John Cornyn, Texas

John Thune, South Dakota

Tim Scott, South Carolina

Bill Cassidy, Louisiana

James Lankford, Oklahoma

Steve Daines, Montana

Todd Young, Indiana

John Barrasso, Wyoming

Ron Johnson, Wisconsin

Thom Tillis, North Carolina

Marsha Blackburn, Tennessee

Roger Marshall, Kansas

Featured Video:

Senate Finance Committee holds hearing on tax fraud

OnAir Post: Finance Committee (Senate)

News

Ranking Member’s News – October 14, 2021

BOISE–Idaho’s U.S. Senator Mike Crapo, Ranking Member of the Senate Finance Committee, joined Idaho leaders, concerned constituents, and business and financial leaders for a roundtable discussion on a proposal to create a reporting scheme where financial intermediaries report to the Internal Revenue Service (IRS) on customer deposits and withdrawals.

The Biden Administration and congressional Democrats are considering an $80 billion boost in IRS funding, and implementing a reporting dragnet under which local banks, credit unions and payment providers will essentially be turned into agents of the IRS, monitoring and reporting of inflows and outflows on deposits and withdrawals made in private accounts. This proposal raises a number of serious concerns regarding Americans’ privacy; data security; and a massive amount of paperwork and confusion for taxpayers and the IRS. In light of these proposals to massively expand the IRS with unprecedented amounts of mandatory funding, and the IRS’s continued abuses of taxpayer rights and privacy, Senator Crapo has introduced legislation to place important guardrails around and IRS funding to protect taxpayer rights and privacy, the TaxGap Reform and IRS Enforcement Act.

Senate Finance Committee Chair Ron Wyden, D-Ore., today issued a statement after the Social Security Administration announced Social Security benefits will increase by 5.9 percent in 2022:

“This increase in Social Security benefits will be welcome for millions of Americans trying to make ends meet after the previous administration’s bungled response to COVID-19 left us in an economic crisis of shortages and price increases,” Wyden said. “Working Americans pay into Social Security with every paycheck, and in return they deserve a secure retirement. I’m going to continue to build on what works and look for ways to improve Social Security for the next generation.”

Committee on Finance (Senate), – September 10, 2021

Washington, D.C. –Senate Finance Committee Chair Ron Wyden, D-Ore., today unveiled draft legislation to close loopholes that allow wealthy investors and mega-corporations to use pass-through entities, primarily partnerships, to avoid paying their fair share of taxes.

Seventy percent of partnership income accrues to the top 1 percent. Current partnership tax rules are too complicated for the IRS to enforce, turning partnerships into a preferred tax avoidance strategy for wealthy investors and mega-corporations. Although computers can check a wage earner’s return, the IRS needs highly-skilled specialists to audit partnerships. It audited only about 0.03 percent of the partnership returns filed for tax year 2018.

Wyden’s bill would remove the complexity in current partnership rules by closing loopholes that essentially allow partners to pick and choose how, and whether, to pay tax. Simply closing these loopholes would raise at least $172 billion, without raising tax rates.

CNBC, – September 7, 2021

Congressional Democrats are floating a slew of taxes to help cover their $3.5 trillion budget plan, including new levies on the wealthy.

Senate Finance Committee Chairman Ron Wyden, D-Ore., has introduced proposals for taxes on so-called derivatives, which are financial contracts linked to assets as well as carried interest, which generally is received by hedge-fund managers and private equity firms.

These measures call for a “mark-to-market” tax, meaning investors may pay levies annually based on market value, and may pave the way for a broader push for similar levies on capital gains, according to a Tax Foundation analysis.

Currently, investors don’t pay taxes on gains or claim a deduction for losses until they sell. However, mark-to-market levies would occur every year, even if they still own the asset.

About

Jurisdiction

The Committee concerns itself with matters relating to: taxation and other revenue measures generally, and those relating to the insular possessions; bonded debt of the United States; customs, collection districts, and ports of entry and delivery; reciprocal trade agreements; tariff and import quotas, and related matters thereto; the transportation of dutiable goods; deposit of public moneys; general revenue sharing; health programs under the Social Security Act, including Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), Temporary Assistance to Needy Families (TANF) and other health and human services programs financed by a specific tax or trust fund; and national social security.

EXCERPT FROM RULE XXV OF THE STANDING RULES OF THE SENATE

1. The following standing committees shall be appointed at the commencement of each Congress, and shall continue and have the power to act until their successors are appointed, with leave to report by bill or otherwise on matters within their respective jurisdictions:

(i) Committee on Finance, to which committee shall be referred all proposed legislation, messages, petitions, memorials, and other matters relating to the following subjects:

- Bonded debt of the United States, except as provided in the Congressional Budget Act of 1974.

- Customs, collection districts, and ports of entry and delivery.

- Deposit of public moneys.

- General revenue sharing.

- Health programs under the Social Security Act and health programs financed by a specific tax or trust fund.

- National social security.

- Reciprocal trade agreements.

- Revenue measures generally, except as provided in the Congressional Budget Act of 1974.

- Revenue measures relating to the insular possessions.

- Tariffs and import quotas, and matters related thereto.

- Transportation of dutiable goods.

Senate Finance Committee

Department and Agency Jurisdiction

The Senate Finance Committee’s jurisdiction is defined by subject matter – not by agency or Department. As a consequence of the Committee’s broad subject matter jurisdiction, the Finance Committee has sole or shared jurisdiction over the activities of numerous agencies and offices.

Executive Office of the President

- Office of the United States Trade Representative

[Leads international trade negotiations; advises and coordinates trade policy; enforces trade agreements]

Department of Agriculture

- Foreign Agriculture Service (w/Agriculture Committee)

[Foreign barriers to U.S. agriculture goods] - Trade Adjustment Assistance for Farmers (lead by FAS but involves numerous USDA departments)

Department of Commerce

- International Trade Administration

[Administration of antidumping and countervailing duty laws; compliance with international trade agreements] - Under Secretary of International Trade Administration (w/Banking Committee)

- Assistant Secretary for Import Administration

- Assistant Secretary for Market Access and Compliance

- Economic Development Administration (w/Environment and Public Works Committee)

[Trade Adjustment Assistance for Firms; Trade Adjustment Assistance for Communities] - Assistant Secretary for Manufacturing and Services

Department of Health and Human Services

- Centers for Medicare and Medicaid Services

[Medicare Parts A & B; Medicare Advantage (Part C); Medicare Drug Benefit (Part D); Medicaid; Children’s Health Insurance Program] - Administration for Children and Families (w/Health, Education, Labor and Pension Committee)

[TANF; Child Welfare Services; Child Support & Paternity; JOBS program; Foster Care & Adoption Assistance; Maternal & Child Health Title XX Social Services Block Grant Program; Child Care and Development Block Grant; Independent Living Program; Promoting Safe and Stable Families]

[Title XI of the Social Security Act, demonstration authority, peer review of the utilization and quality of health care services, and administrative simplification] - Inspector General

Department of Homeland Security

The following functions performed by any employee of the Department of Homeland Security:

- Any customs revenue function including any function provided for in section 415 of the Homeland Security Act of 2002 (P.L. 107-296);

- Any commercial function or commercial operation of the Bureau of Customs and Border Protection or Bureau of Immigration and Customs Enforcement, including matters relating to trade facilitation and trade regulation; or

- Any other function related to the above items that were exercised by the United States Customs Service on the day before the effective date of the Homeland Security Act of 2002. (Public Law 107-296)

- Commissioner, U.S. Customs and Border Protection

Department of Labor

- Employment and Training Administration (w/Health, Education, Labor and Pensions Committee)

[Unemployment Compensation; Trade Adjustment Assistance for Workers] - Pension and Welfare Benefits Administration [ERISA] (w/Health, Education, Labor and Pensions Committee and Foreign Relations Committee)

[Formulating and implementing international trade policy] - International Labor Affairs Bureau

- Unemployment Insurance

Department of the Treasury

- Internal Revenue Service

- Bureau of the Public Debt

- Any customs, tariff, or revenue function not delegated to the Department of Homeland Security through the delegation authority provided by the Homeland Security Act of 2002 (Public Law 107-296)

- Assistant Secretary for International Affairs [Formulating and implementing international trade policy]

- Under Secretary for International Affairs

- Financial Management Service (w/Homeland Security and Governmental Affairs Committee)

- Bureau of Alcohol, Tobacco and Firearms (w/Judiciary Committee)

[In relation to revenues] - Undersecretary for Enforcement

[Matters involving financial crimes, including terrorist financing] - Assistant Secretary for Enforcement

[Matters involving financial crimes, including terrorist financing] - Assistant Secretary for Terrorist Financing and Financial Crimes

[Matters involving financial crimes, including terrorist financing; enforces sanctions] - ERISA group health plans

[HIPAA, COBRA, Consumer Protections]

(With Health, Education Labor and Pensions Committee) - Taxpayer Advocate

- Inspector General

- Inspector General for Tax Administration

Pension Benefit Guaranty Corporation (PBGC)

(w/Health, Education, Labor & Pensions Committee)

[Guarantees payment of non-forfeitable pension benefits in covered private sector defined benefit pension plans; title IV of ERISA]

- TAA program for workers

Social Security Administration (SSA)

- Old-Age, Survivors and Disability Insurance (OASDI)

- Supplemental Security Income (SSI)

[Provides monthly cash benefits to eligible beneficiaries] - Inspector General

Railroad Retirement Board

- Railroad Retirement

United States International Trade Commission

[Furnishes studies/recommendations on numerous trade issues to the President and Congress, may order certain remedial actions in response to trade violation

U.S. Tax Court

Also numerous boards, commissions, and advisors committees including:

- Prospective Payment Assessment Commission;

- Physician Payment Review Commission;

- Advisory Committee for Trade Policy, Negotiations and Industry;

- Trade and Environmental Policy Advisory Committee;

- Intergovernmental Policy Advisory Committee;

- Labor Advisory Committee;

- Agricultural Policy Advisory Committee;

- Agricultural Technical Advisory Committee for Trade

- Congressional – Executive Commission on China;

- Social Security Advisory Board;

- National Railroad Retirement Investment Trust; and

- Industry Trade Advisory Committees.

Source: Committee website

FAQs

Committee Information

Committee Hearings

Committee Documents

Committee Business

Source: Committee website

History

The Committee on Finance is one of the original committees established in the Senate. First created on December 11, 1815, as a select committee and known as the Committee on Finance and an [sic] Uniform National Currency, it was formed to alleviate economic issues arising from the War of 1812. On December 10, 1816 the Senate officially created the Committee on Finance as a standing committee. Originally, the Committee had power over tariffs, taxation, banking and currency issues and appropriations. Under this authority the committee played an influential role in the most heated topics of the era; including numerous tariffs issues and the Bank War.[2] The committee was also influential in the creation of the Department of Interior in 1849.[3] Under the Chairmanship of William Pitt Fessenden, the committee played a decisive role during the Civil War. Appropriating all funds for the war effort as well as raising enough funds to finance the war through tariffs and the nation’s first income tax. Additionally, the committee produced the Legal Tender Act of 1862, the nation’s first reliance on paper currency.

In 1865 the House of Representatives created an Appropriations Committee to relieve the burden from the Committee on Ways and Means. The Senate followed this example by forming the Senate Appropriations Committee in 1867.

Despite the loss of one of its signature duties the committee continued to play a prominent role in the major issues of the nation. The committee was at the center of the debate over the silver question in the latter half of the 19th Century. Passage of the Bland–Allison Act and the Sherman Silver Purchase Act were attempts to remedy the demand for silver, though the silver cause would eventually fail by the end of the century. The committee also continued to play a role in the debate over income taxes. The repeal of the Civil War income taxes in the 1870s would eventually be raised in 1894 with the passage of a new income tax law. The Supreme Court’s decision in Pollock v. Farmers’ Loan & Trust Co., 157 U.S. 429 (1895) ruled the income tax as unconstitutional, since it was not based on apportionment. The fight for an income tax finally culminated with the Payne–Aldrich Tariff Act of 1909. In order to pass the new tariff Senate leaders, including Chairman Nelson Aldrich, allowed for a Constitutional Amendment to be passed. Four years later the 16th Amendment was officially ratified and in 1913 the nation’s first peacetime income tax was instituted.

Around that same time the committee lost jurisdiction over banking and currency issues to the newly created Committee on Banking and Currency. The committee did gain jurisdiction over veterans’ benefits when it successfully passed the War Risk Insurance Act of 1917. The act shifted pensions from gratuities to benefits and which served as one of the first life insurance programs created under the federal government.

The Finance Committee continued to play an increasingly important role in the lives of the nation’s veterans. The committee helped to consolidate the veteran bureaucracy by streamlining the various responsibilities into a Veterans’ Bureau which ultimately would become the Veterans’ Administration. In 1924 the committee passed a “Bonus Bill” for World War I veterans which compensated veterans of that war for their service.[7] These series of increasing and providing better benefits for veterans reached a crescendo in 1944 with the passage of the Servicemen’s Readjustment Act. Senator Bennett “Champ” Clark, who served as the Chairman of the Subcommittee on Veterans, assured smooth sailing of the bill through the Senate. The bill not only ended the usual demands from returning veterans which had been seen in nearly every war America had participated in, but also provided the most generous benefits that veterans had ever received, including continuing education, loans and unemployment insurance.

Not all Finance Committee legislation was as well received as the G.I. Bill. At the beginning of the Great Depression the committee passed the Smoot–Hawley Tariff Act. The act greatly increased tariffs and had a negative effect on the nation’s economy. Following traditional economic practices the members of the committee, including Chairman Reed Smoot, felt that protection of American businesses was required in order to buoy them during the dire economic times. The effort backfired and the economic situation worsened. The Smoot-Hawley Tariff would eventually be replaced by the Reciprocal Tariff Act of 1934 which authorized the President to negotiate trade agreements. This act not only set up the trade policy system as it exists today but also effectively transferred trade making policy from the Congress to the President.

The committee also played an important role in two major acts created under the New Deal. The committee received jurisdiction over the National Industrial Recovery Act because of tax code changes in the bill. The new bureaucracy was President Franklin D. Roosevelt’s attempt to stimulate the economy and promote jobs for unemployed Americans while also regulating businesses. The National Recovery Administration would ultimately fail as it lost public support but the act served as a springboard to the Wagner Act and the National Labor Board.

Probably the single biggest, and by far one of the most lasting, piece of legislation enacted by the Finance Committee during the New Deal was the Social Security Act. Once again the committee received jurisdiction owing to the payroll taxes that would be enacted to pay for the new program. The act was the first effort by the federal government to provide benefits to the elderly and the unemployed. The act greatly enhanced the economic welfare of many elderly Americans.

In 1981, a Senate Resolution required the printing of the History of the Committee on Finance.

Source: Wikipedia

Role

The role of the Committee on Finance is very similar to that of the House Committee on Ways and Means. The one exception in area of jurisdiction is that the Committee on Finance has jurisdiction over both Medicare and Medicaid, while the House Ways and Means Committee only has jurisdiction over Medicare. (The House Energy and Commerce Committee has jurisdiction over Medicaid.) The other difference in terms of power is that all revenue raising measures must originate in the House giving the Ways and Means Committee a slight edge in setting tax policy. In addition to having jurisdiction over legislation the Committee has extensive oversight powers. It has authority to investigate, review and evaluate existing laws, and the agencies that implement them.

It is considered to be one of the most powerful committees in Congress.

Source: Wikipedia

Contact

Locations

Honorable Ron Wyden Chairman

Committee on Finance

United States Senate

219 Dirksen Senate Office Building

Washington, D.C. 20510

Phone: 202-224-4515

Fax: 202-228-0554

Honorable Mike Crapo Ranking Member

Committee on Finance

United States Senate

219 Dirksen Senate Office Building

Washington, D.C. 20510

Web Links

Legislation

Bills

Source: Committee website

Hearings

Source: Committee website

Subcommittees

The Finance Committee has six subcommittees that allow members a forum to examine specific areas within the Committee’s jurisdiction. Subject to the formal approval of the full committee, the Chairman and Ranking Member establish the Committee’s subcommittees and membership for each Congressional session. The Chairman and Ranking Member serve as ex officio members of all subcommittees. Refer to Rule 17 of the Committee on Finance Rules of Procedures for more information about subcommittees. For the 117th Congress, the Committee’s subcommittees include:

Subcommittee on Energy, Natural Resources, and Infrastructure

Majority Members:

Debbie Stabenow, Michigan, Chair

Ron Wyden, Oregon, Chairman

Tom Carper, Delaware

Michael Bennet, Colorado

Catherine Cortez Masto, Nevada

Minority Members:

James Lankford, Oklahoma, Ranking Member

John Cornyn, Texas

Tim Scott, South Carolina

John Barrasso, Wyoming

Subcommittee on International Trade, Customs, and Global Competitiveness

Majority Members:

Tom Carper, Delaware, Chairman

Maria Cantwell, Washington

Bob Menendez, New Jersey

Ben Cardin, Maryland

Sherrod Brown, Ohio

Michael Bennet, Colorado

Bob Casey, Pennsylvania

Mark Warner, Virginia

Catherine Cortez Masto, Nevada

Minority Members:

John Cornyn, Texas, Ranking Member

John Thune, South Dakota

Bill Cassidy, Louisiana

Steve Daines, Montana

Todd Young, Indiana

John Barrasso, Wyoming

Ron Johnson, Wisconsin

Thom Tillis, North Carolina

Subcommittee on Health Care

Majority Members:

Ben Cardin, Maryland, Chairman

Ron Wyden, Oregon

Debbie Stabenow, Michigan

Bob Menendez, New Jersey

Tom Carper, Delaware

Bob Casey, Pennsylvania

Mark Warner, Virginia

Sheldon Whitehouse, Rhode Island

Maggie Hassan, New Hampshire

Catherine Cortez Masto, Nevada

Elizabeth Warren, Massachusetts

Minority Members:

Steve Daines, Montana, Ranking Member

Chuck Grassley, Iowa

John Thune, South Dakota

Tim Scott, South Carolina

Bill Cassidy, Louisiana

James Lankford, Oklahoma

Todd Young, Indiana

John Barrasso, Wyoming

Ron Johnson, Wisconsin

Marsha Blackburn, Tennessee

Subcommittee on Social Security, Pensions, and Family Policy

Majority Members:

Sherrod Brown, Ohio, Chairman

Ron Wyden, Oregon

Bob Casey, Pennsylvania

Maggie Hassan, New Hampshire

Elizabeth Warren, Massachusetts

Minority Members:

Thom Tillis, North Carolina, Ranking Member

Bill Cassidy, Louisiana

Todd Young, Indiana

Marsha Blackburn, Tennessee

Subcommittee on Taxation and IRS Oversight

Majority Members:

Michael Bennet, Colorado, Chairman

Ron Wyden, Oregon

Bob Menendez, New Jersey

Ben Cardin, Maryland

Mark Warner, Virginia

Sheldon Whitehouse, Rhode Island

Elizabeth Warren, Massachusetts

Minority Members:

John Thune, South Dakota, Ranking Member

Chuck Grassley, Iowa

John Cornyn, Texas

James Lankford, Oklahoma

Ron Johnson, Wisconsin

Marsha Blackburn, Tennessee

Subcommittee on Fiscal Responsibility and Economic Growth

Majority Members:

Maggie Hassan, New Hampshire, Chairman

Ron Wyden, Oregon

Minority Members:

Chuck Grassley, Iowa, Ranking Member

More Information

Library

Source: Committee website

Welcome to the Senate Finance Committee Library where you can find official public records produced by the Senate Finance Committee each congressional session. Records housed in the Library have been categorized by type and include: hearing transcripts, executive session transcripts, committee reports, committee prints and conference reports. Visitors may search by keyword and/or congressional session. Committee publications not currently available online may be accessed in Federal depository libraries throughout the United States.

Printed Hearings

A printed hearing is an official transcript of a hearing. Supplemental materials may be printed as part of the hearing record. For example, a committee might include exhibits, charts and research materials, written statements of witnesses, witness responses to follow-up questions, other materials submitted by witnesses, or letters and testimony from individuals who did not testify in person.

Committee Reports

Committee reports accompany a bill that has been reported to the full Senate for its consideration. Reports may include the legislative text of the bill, changes made by the Committee during open executive sessions, and the views of Finance Committee members.

Committee Prints

Committee prints take many forms and may include: draft reports and bills, legislative analyses, investigative reports, statistical materials and historical reports. Notable types of committee prints include: the Committee Calendar, which indexes all hearings, nominations and legislation considered in a congressional session; technical descriptions of the effects of pending legislation; and the committee rules of procedure adopted each Congress.

Conference Reports

A conference report is an agreement on a bill negotiated by a conference committee, a temporary committee comprised of House and Senate members. Conference reports are printed and submitted to each chamber for consideration. A conference report includes changes to the bill made during the conference committee’s consideration and may also include the views of conference committee members.

Nominations

Source: Committee website

Campaign Finance

Source: Open Secrets webpages