In economics, inflation is a general increase in the prices of goods and services in an economy. This is usually measured using the consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money.

The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index.[9] As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose.

- In the ‘About’ section of this post is an overview of the issues or challenges, potential solutions, and web links. Other sections have information on relevant legislation, committees, agencies, programs in addition to information on the judiciary, nonpartisan & partisan organizations, and a wikipedia entry.

- To participate in ongoing forums, ask the post’s curators questions, and make suggestions, scroll to the ‘Discuss’ section at the bottom of each post or select the “comment” icon.

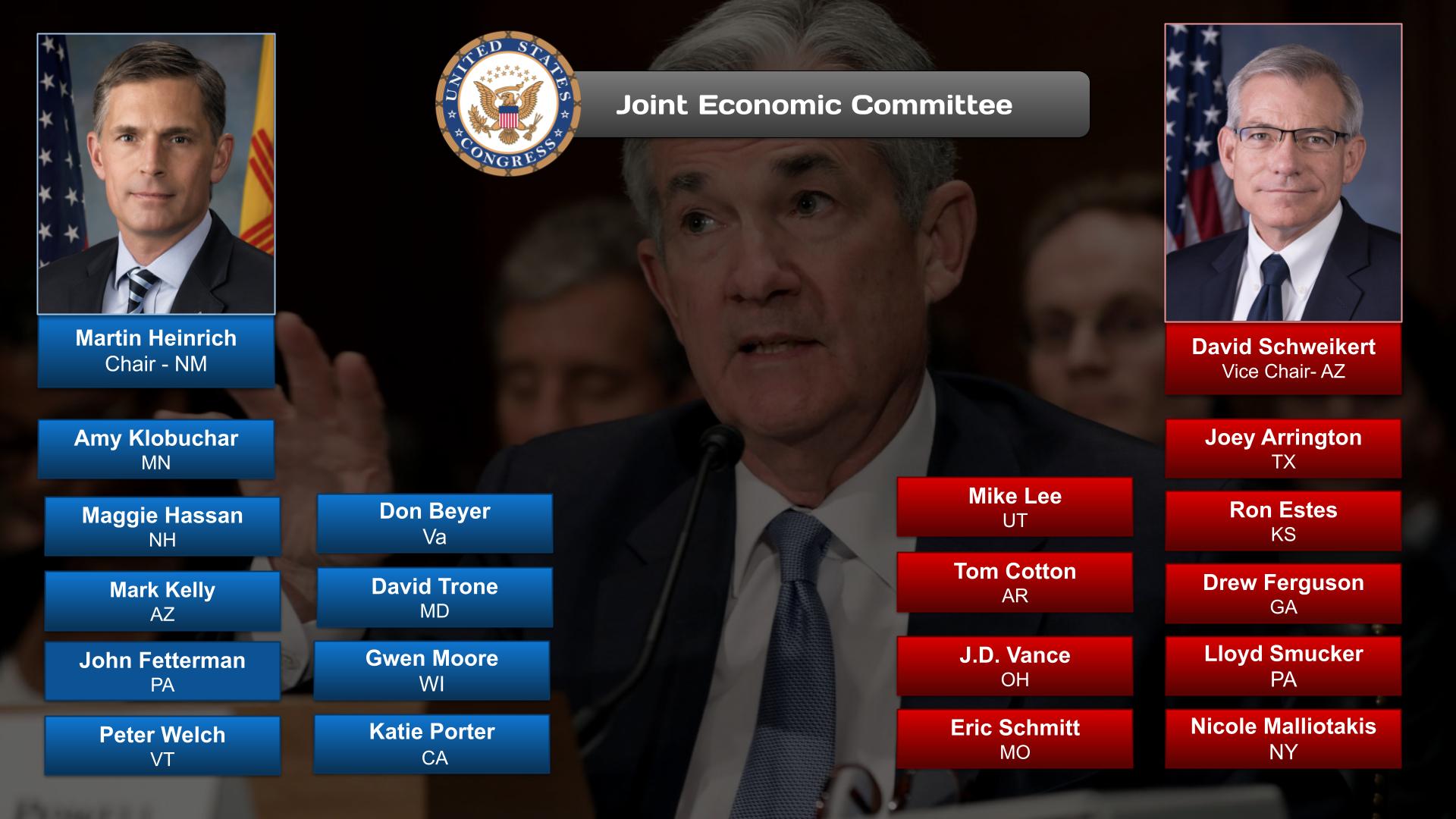

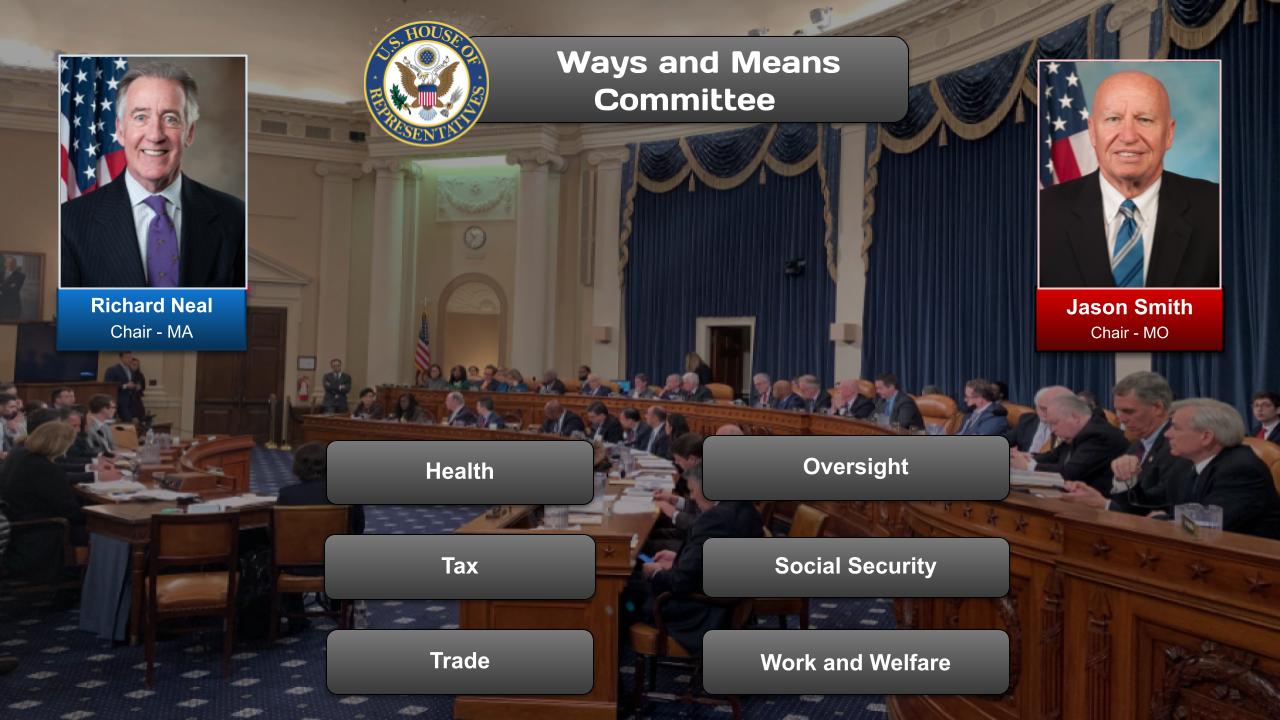

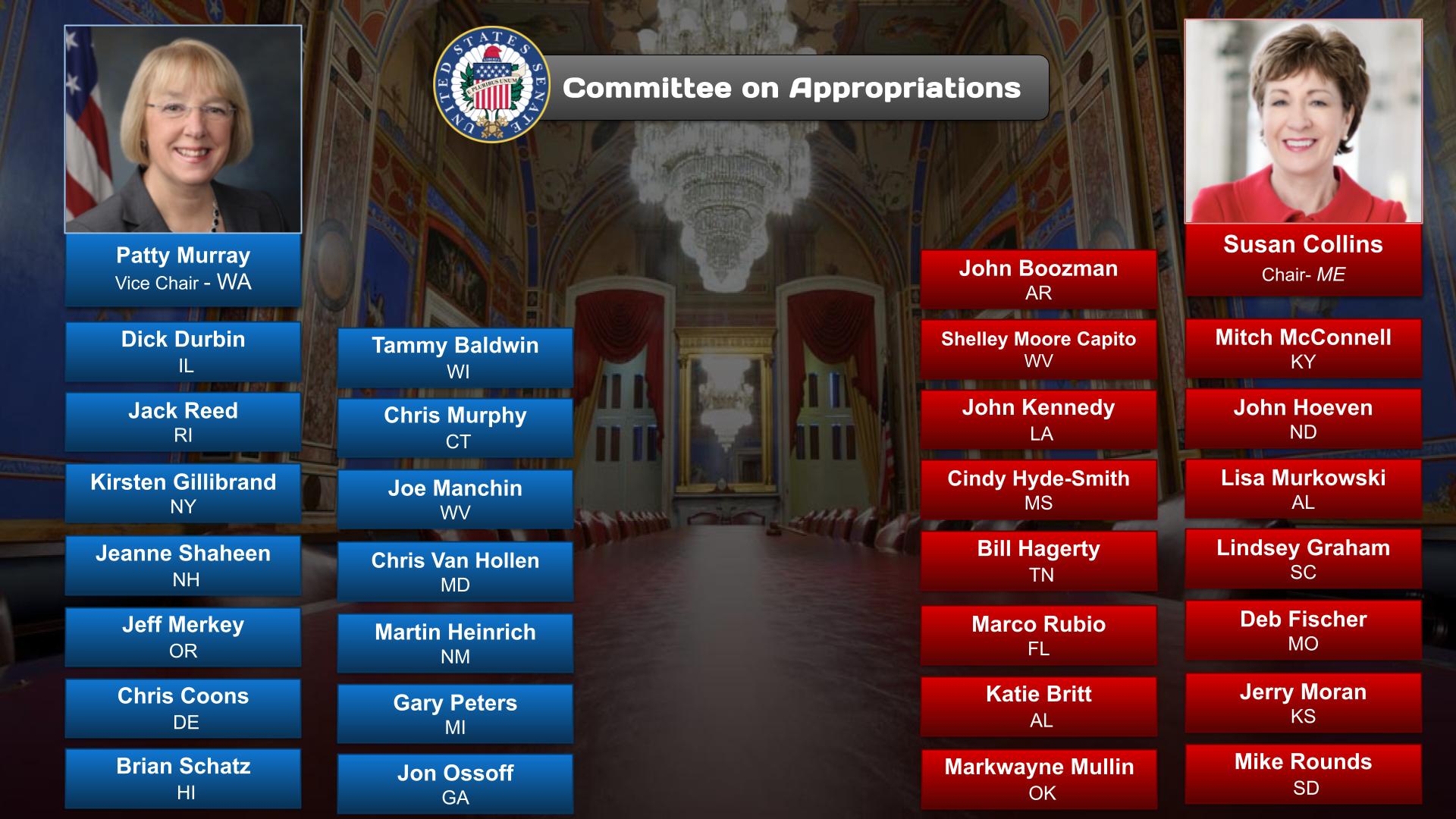

The Inflation category has related posts on government agencies and departments and committees and their Chairs.

Vox – 15/05/2024

https://www.youtube.com/watch?v=NLtnm_bRzPw

Over the past few years, most of the world has experienced some pretty intense inflation, with prices rising as much as 10 percent in a single year. In 2024, even though inflation rates have fallen to more manageable levels, prices are still way up and are very unlikely to come down. Which, understandably, continues to be a source of major stress for people all over the world. So why can’t prices just stay the same?

As a consumer, steady prices and zero inflation seems like the ideal: You want your purchasing power to stay the same and for your dollar today to buy you exactly the same amount as your dollar tomorrow. But even in times of global economic health and stability, governments and their central banks actively avoid letting inflation get too low. That’s because 0 percent inflation might actually end up doing more harm than good.

In this video, we take a look at the reasons why.

OnAir Post: Inflation